Right now we are witnessing the government developing and coordinating measures aimed at addressing issues in the housing market. It is expected that various aspects and categories of citizens will be affected, such as investors, tenants, landlords, and the government itself as a source of social housing.

In this article, we want to show you where it may be more advantageous to invest your savings in real estate in Portugal at the moment. However, the government's package of measures called "More Housing" could significantly influence the current situation and the attractiveness of this market for investors in the future, so we continue to monitor the situation and will be able to provide our analysis once the measures are implemented. At the end of the article, you will also be able to learn about the status of the implementation of this package.

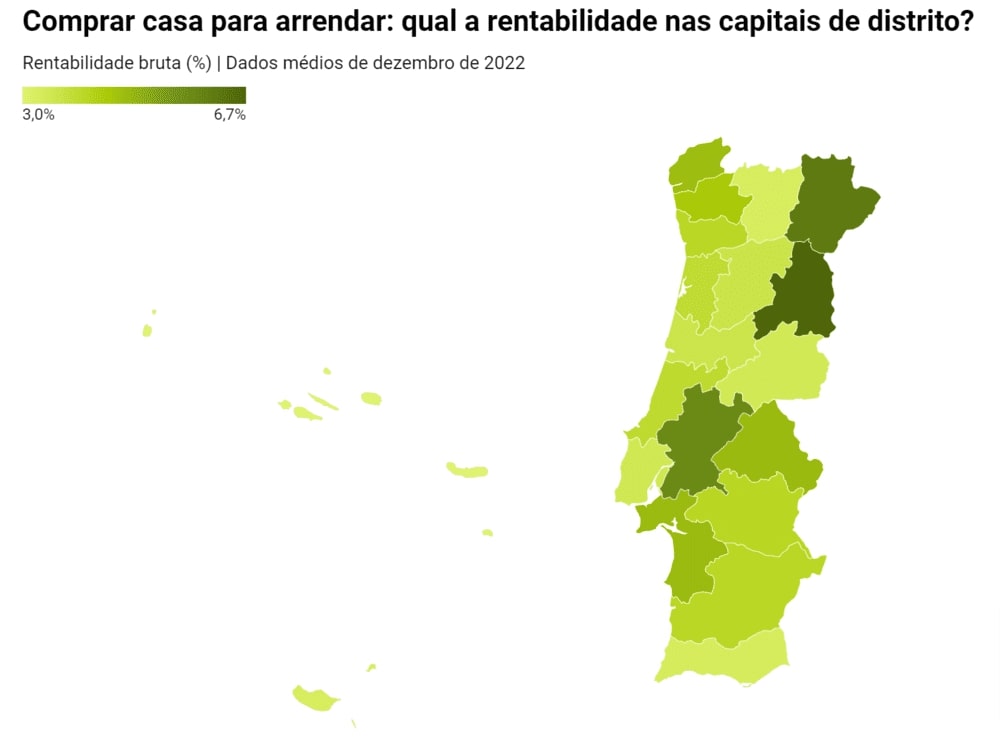

How gross profit from rental housing varies depending on the distance to the most economically developed cities.

We can give an immediate answer based on data from Idealista specialists. Currently, cities within the continent are more profitable compared to cities such as Lisbon and Porto (the full Idealista report can be found here). However, more profitable assets have higher investment risks, and this situation is no exception.

The image below shows the profitability of real estate in regional centers (on the Idealista website, this map is interactive).

Let's explore how the specialists made their conclusions and confirm or refute them by analyzing the listings on the Idealista website at the time of writing this article in early April 2023.

According to specialists as of December 2022, the city of Guarda, the highest-altitude city in the country, had the highest gross profit margin in the real estate market: 6.66% in gross terms, not taking into account taxes and property and purchase fees. This figure was calculated based on the average purchase price of real estate at 799 euros per square meter and an average rent of 5.2 euros per square meter per month.

Let's try to search for real estate in this region for purchase.

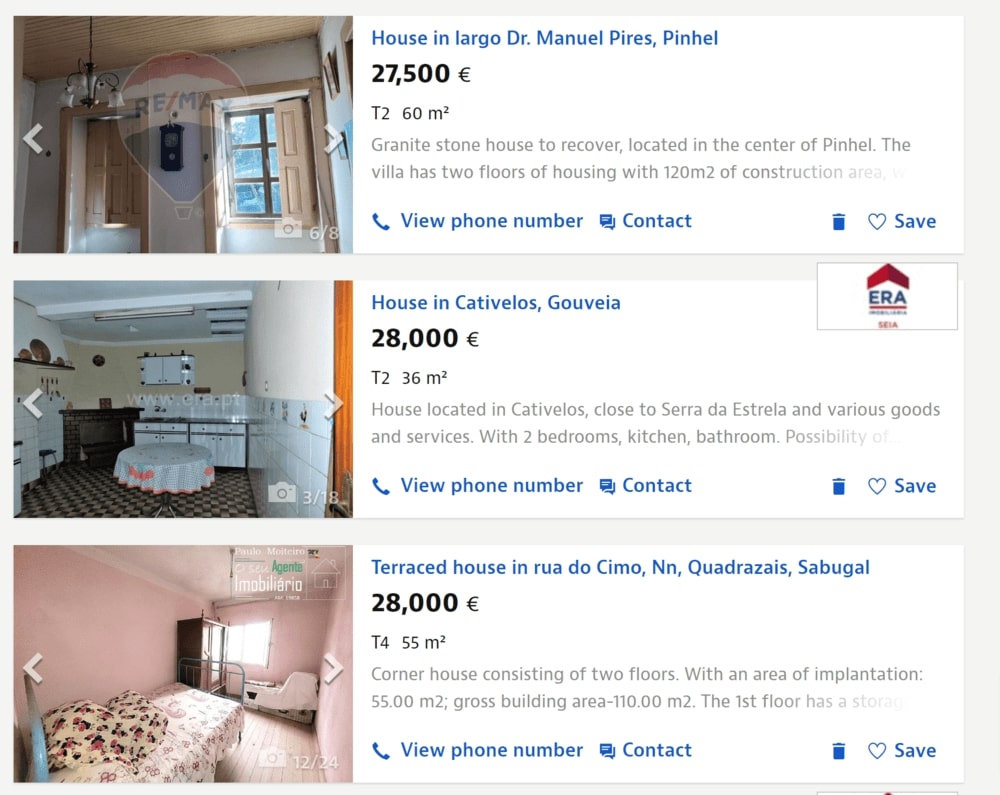

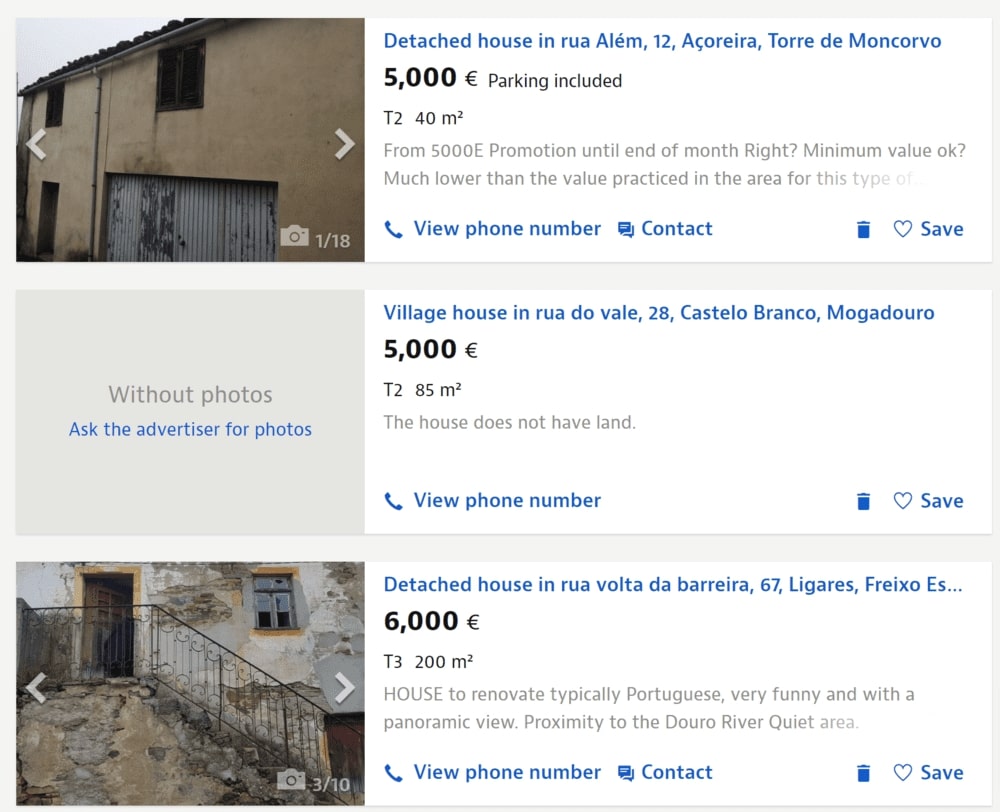

We have set filters from the lowest price to the highest. Immediately noticeable are the numerous abandoned properties that require extensive renovation. Such properties can be purchased starting at 5000 euros.

It is interesting to consider how the presence of numerous abandoned properties has affected the statistics.

However, we are searching for properties that are potentially ready for future tenants to move in.

The first available options, where there is no need for extensive renovation, start from 540-770 euros per square meter. It is worth noting that we are not conducting any additional evaluation of the location, quality of the property, or cost of necessary repairs. Despite the lack of consideration of these parameters in this article, they are undoubtedly important. Understanding key aspects and common mistakes in property purchase can significantly increase gross profitability.

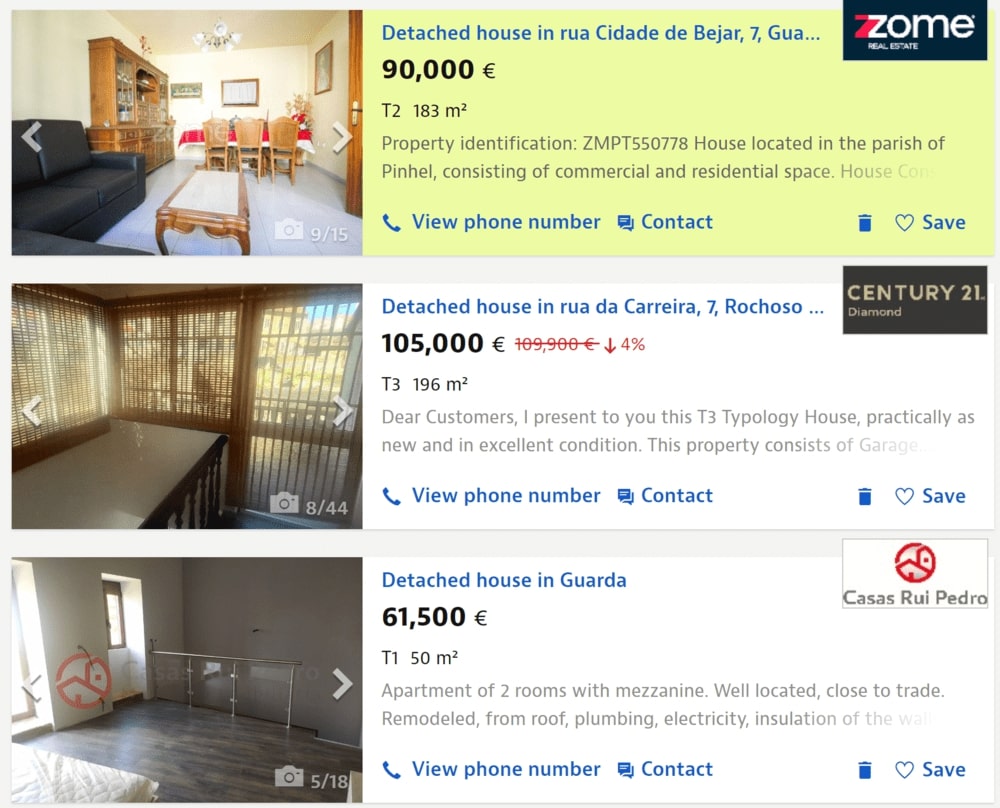

Filtering for new properties did not yield any results, suggesting that new construction is not currently taking place in the region.

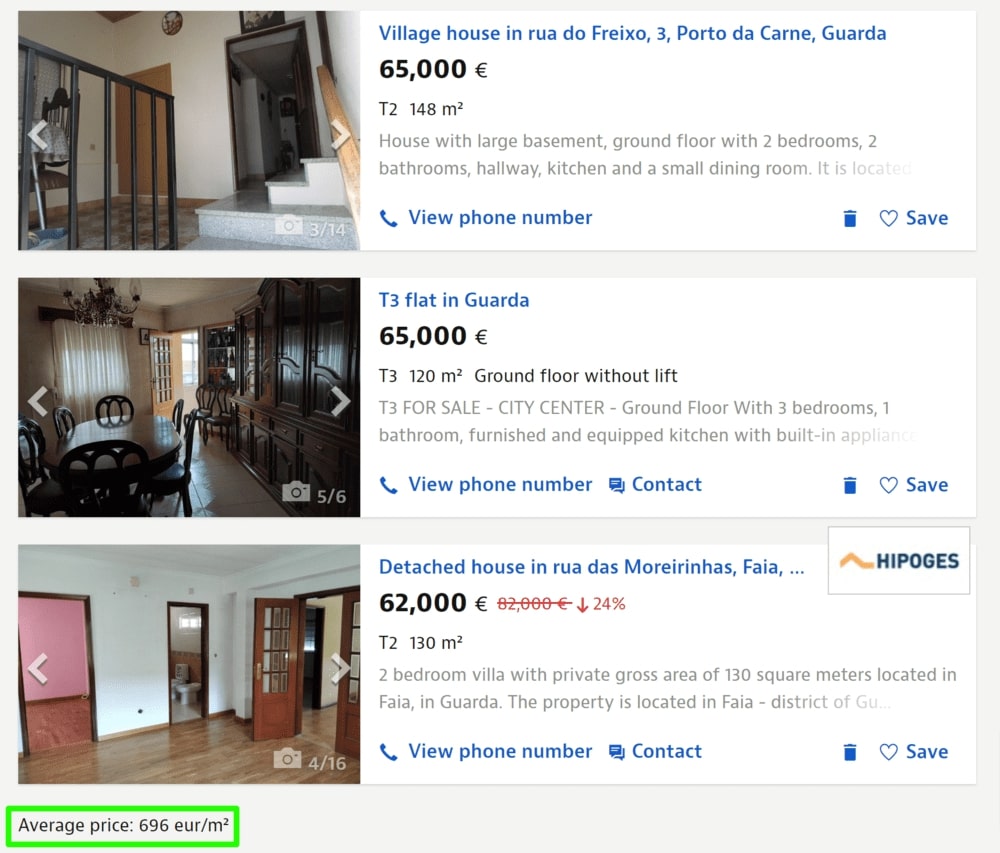

In the city of Guarda, prices are significantly higher, although there is a wide range from 254 euros per square meter to 1600 euros, depending on the size, quality of renovation, and location. A large portion of housing is priced in the range of 750 to 1200 euros per square meter.

Idealista shows the current average purchase price at 696 euros per square meter.

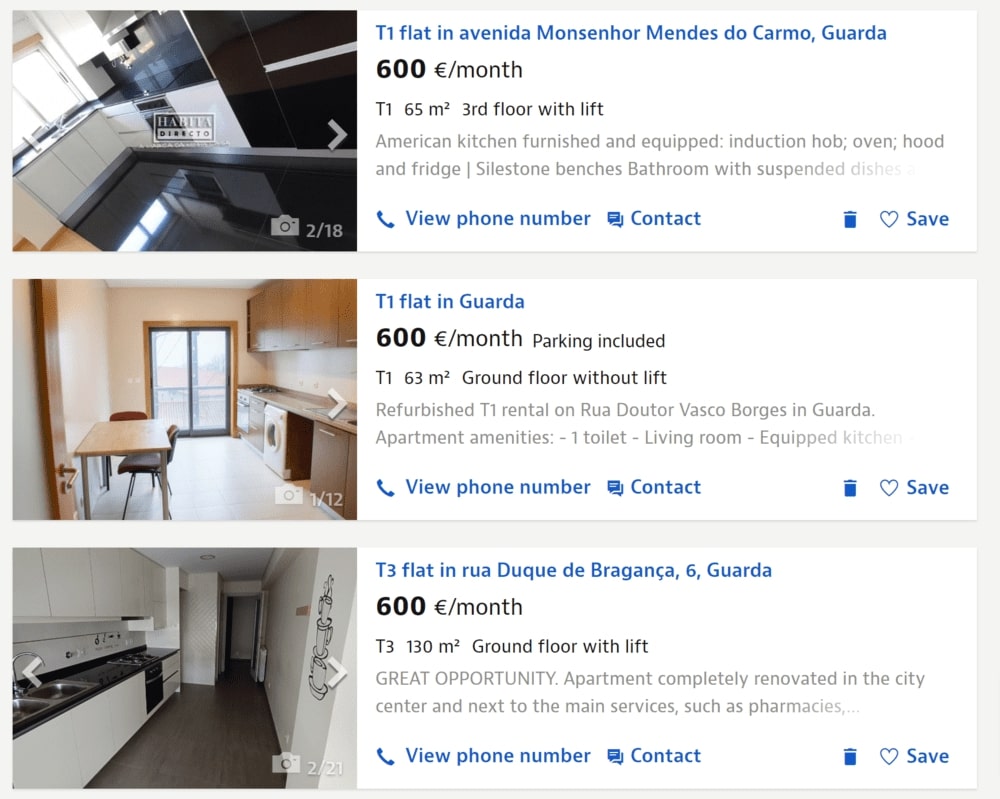

Now let's take a look at rentals. They start at 380 euros per month (4.6 euros per square meter per month), but such a price is more of an exception. A large pool of suitable rental housing is priced around 600 euros per month. This price can apply to properties ranging from 70 to 120 square meters, resulting in a range of 6 to 8.5 euros per square meter per month. The Idealista platform currently estimates the average rental price at 6.57 euros per square meter per month.

While we were able to find similar purchase prices to those presented by Idealista specialists in their 2022 analysis, we did not see similar rental prices, even at the minimum level.

In summary, as of December 2022, the average purchase price was 799 euros/m2, and currently, it is 696 euros/m2. The average rental price was 5.2 euros/m2 per month in 2022 and is now 6.57 euros/m2 per month.

It should be noted that without a deep statistical analysis, it is impossible to determine whether rental prices are increasing in this region with relatively stable purchase prices, as well as to what extent people continue to rent and buy property in the area. Furthermore, all assumptions and statistics are based on listed prices by market participants, rather than actual transaction amounts.

To understand the potential investment attractiveness of this region, it was obvious for us to at least look at available census data for the area and articles on the subject. As of 2021, the population of the entire district where the city is located has decreased by approximately 12.6% since 2011. In the city of Guarda, the decrease is less, at 5.7%, which is the lowest in the district. It should be noted that the population of Portugal as a whole decreased by 2.1% over this 10-year period. Perhaps in addition to internal migration, the overall population decline has also affected these figures.

Unfortunately, there is no more recent data available yet, or it is not public, to understand whether the trend of population decline in this district continues.

In our article "Where do foreigners buy and rent property in Portugal" Guarda appears on both lists where foreigners are buying and renting property. In terms of buying real estate in Guarda, the share of foreign investment has decreased since 2019, while in terms of renting, the share of foreign tenants is increasing.

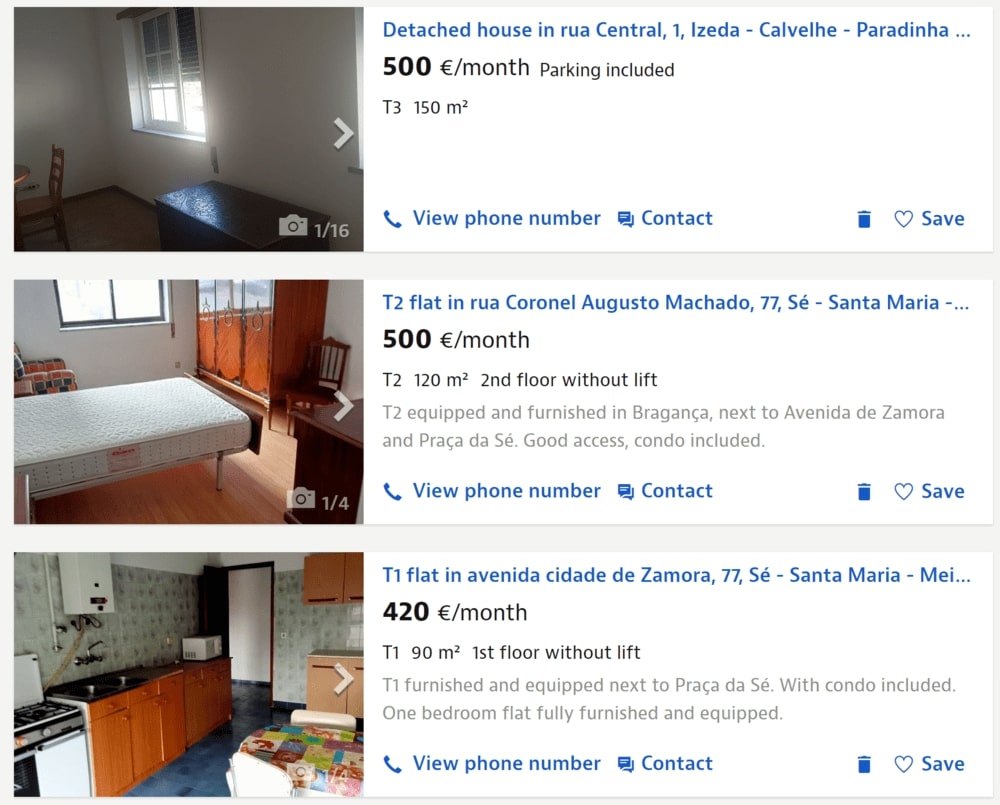

According to the specialists, the second city with a high level of profitability is Bragança, located in the north of the country. In this district center, the purchase of a house cost 865 euros/m2 in December 2022, while the average rental price was 5.2 euros/m2 (the same as in Guarda). The profitability in this case was 6.16% in December 2022.

Here, the list starts with buildings that will most likely require major repairs or even demolition to build a new house. The price range is between 5000-45,000 euros depending on the square footage, the presence of a backyard plot, and the age of the structure.

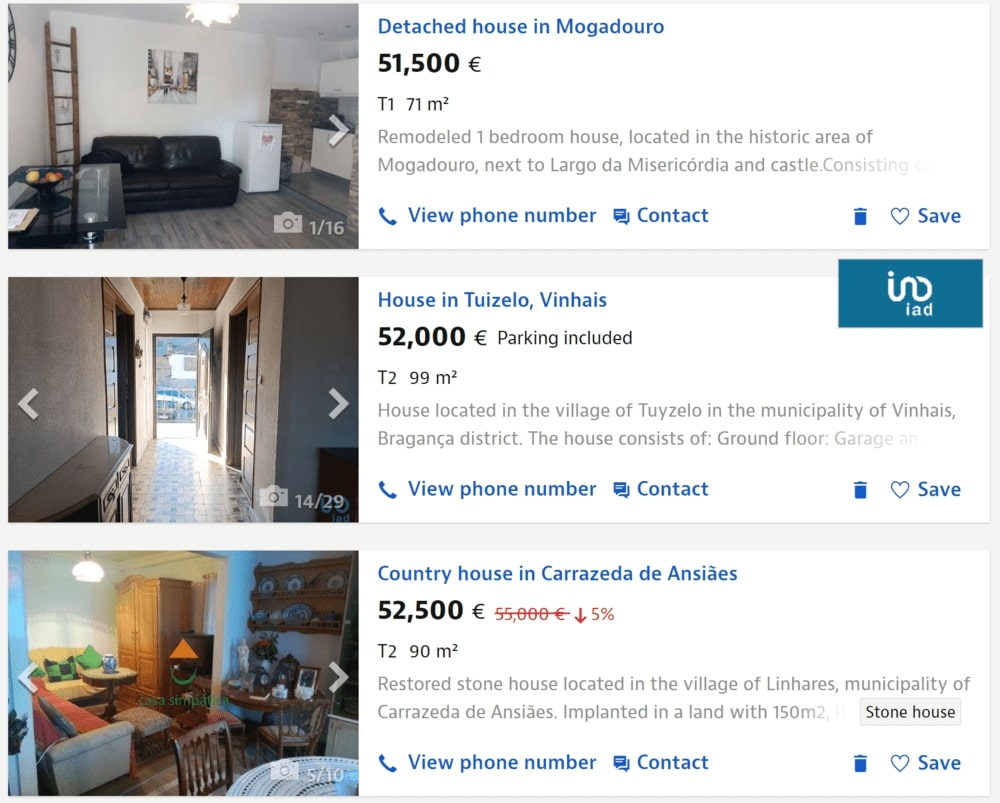

More or less, premises suitable for living start at 50,000 euros. Given the square footage, this is approximately 600 euros per square meter. Subjectively, this threshold is higher here than in Guarda. According to the current listings on Idealista, the average price per square meter in the district is 820 euros, and in the city of Bragança itself, it is 897 euros per square meter.

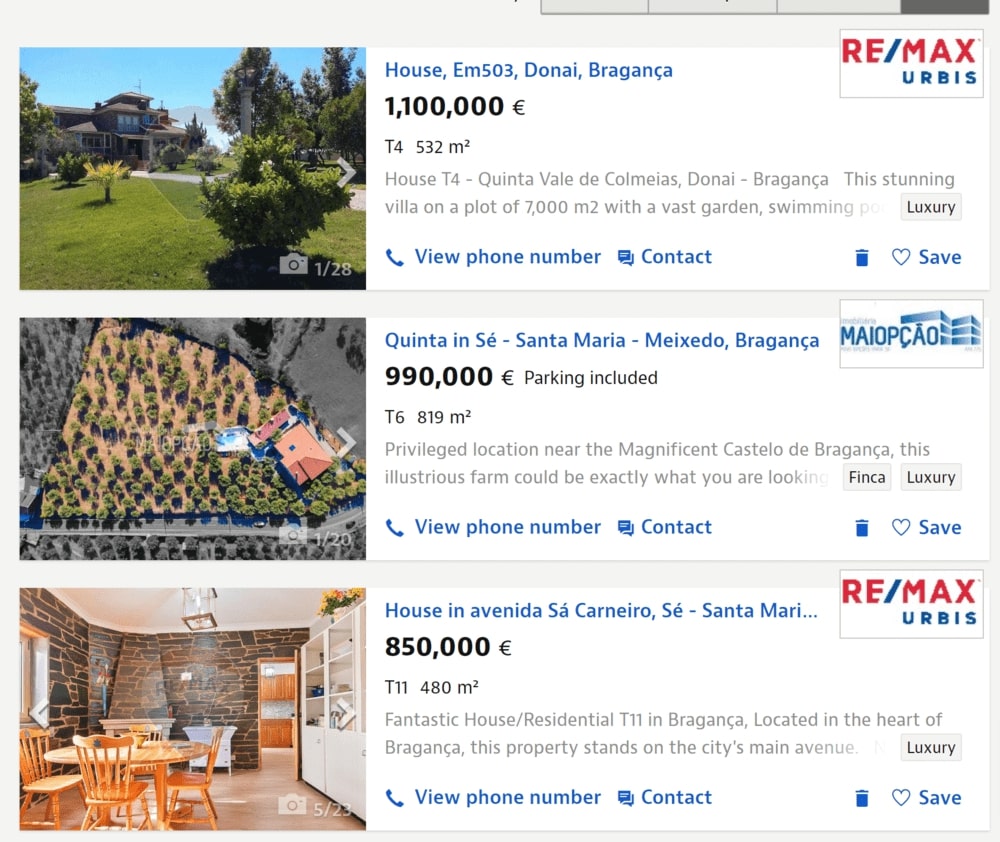

The most expensive real estate in the city, when calculated per square meter, turns out to be cheaper than the average values in Lisbon, but due to the large number of square meters, this property falls into the list of local elite properties.

There are no new buildings in the entire district, except for one project that is only presented in visualizations.

We were surprised by the rental market in this region, which is represented by only 11 properties at the time of writing the article. The price range is between 400-600 euros per month, on average 2.7 euros per square meter per month. Two suspicious high-rent offers had to be removed from the statistics, which adjusted the average indicator to the level of 6.1 euros per square meter per month.

This is somewhat puzzling, as the cost of buying property in this region is higher than in Guarda, but rental offers seem to be at an even lower price level than what Idealista showed in 2022.

In the aforementioned article "Where foreigners buy and rent property in Portugal" Bragança is also included in the lists of top cities where foreigners buy and rent property. Unlike Guarda, the share of foreign capital in this city has increased, including in the purchase of real estate.

Perhaps, based on everything said above, one can conclude that there is a severe shortage of quality rental housing in Bragança at the moment.

However, in terms of population census, all municipalities in the Bragança district show a decline in population figures. The entire region has seen a 10% decrease in the number of residents compared to 2011. Again, there is no more recent data to confirm or refute this trend.

In addition to the district capitals of Guarda and Bragança, Santarém and Portalegre are also highlighted as cities with high rental yields (5.78% and 4.73%, respectively).

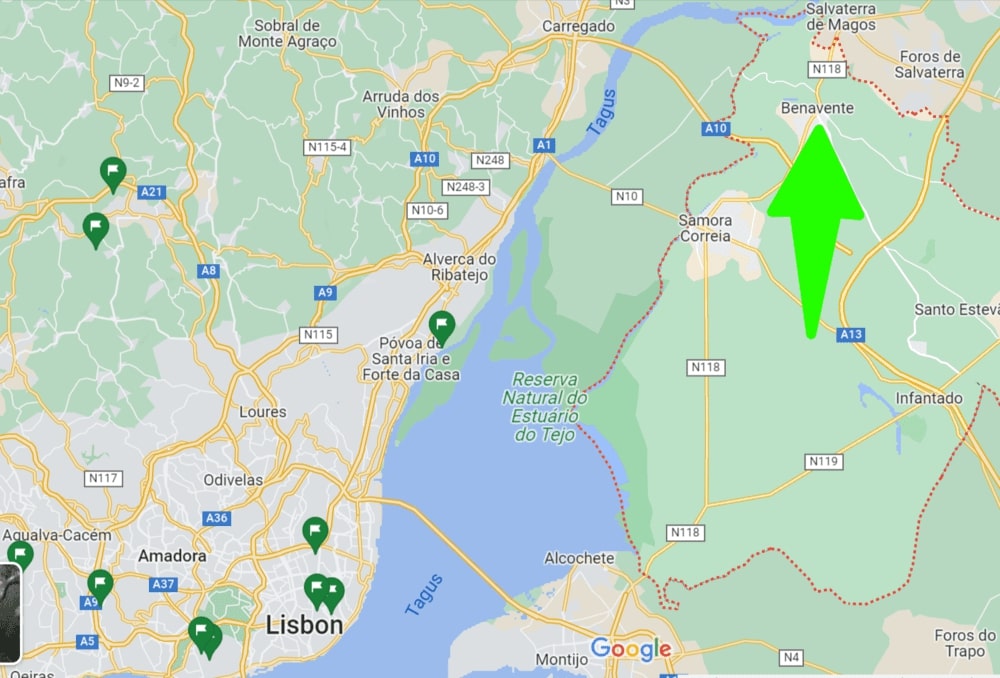

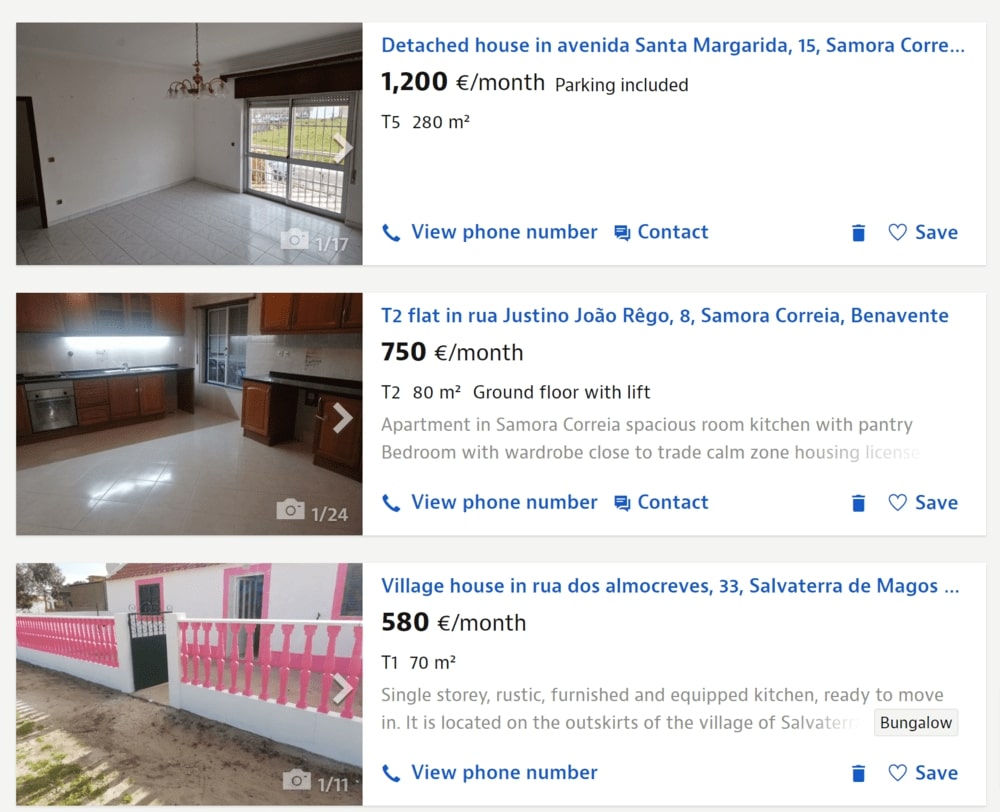

Interestingly, according to the 2021 census data, Portalegre is considered the capital of the district, which has lost the most residents. The Santarém district also is losing residents, but unlike the district capital, there is a municipality, Benavente, where there is even a growth in the number of residents.

We decided to take a closer look at this town, while Santarém and Portalegre we suggest you explore on your own. And here, we were surprised again. The average purchase price in this municipality was 1671 euros per square meter, mainly due to very expensive houses, villas, and future new projects. At the same time, the rental market is represented by only three apartments in the entire town and surrounding area.

Whether this is an investment opportunity remains to be seen.

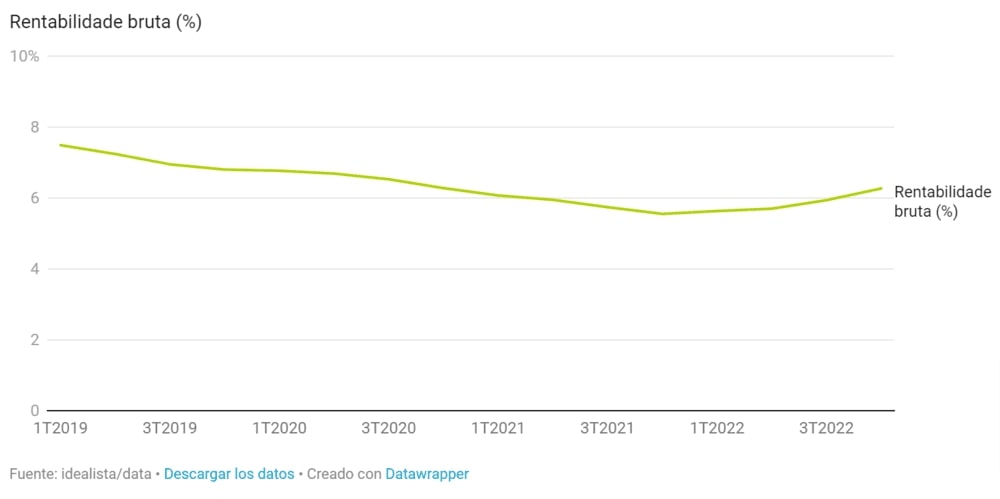

All the data and examples we have provided above can be compared to the country's indicators for 2022. The maximum gross business profitability reached 6.27% in the last quarter of the year, while houses for sale cost on average 2475 euros per square meter, and the rental price for housing was fixed at 12.9 euros per square meter. These last two values have become record-breaking for Portugal in recent years.

Low housing prices for purchase in internal regions compared to the national level, combined with high demand for rental properties, provide attractive profitability.

Where is it less profitable to buy property for rent?

The answer follows from the previous paragraphs: in those cities that are already the most developed, where the cost of housing is already high, and where there are more employment opportunities.

It's just like with securities: higher returns come with higher risks, if you want less risk, you'll receive less return.

The city with the lowest gross profitability in December 2022 was Ponta Delgada in the Azores Autonomous Region (3.01%). Next on the list are Vila Real (3.25%) and Funchal on Madeira (3.26%).

These and similar cities with low profitability may not only be suitable from the perspective of low risk. In our opinion, if you want to move to these places in the long term or leave your property as an inheritance, buying real estate in these cities rather than in more profitable internal cities can be a wise investment in your case.

If gross profitability is higher in some regions, what are the investment risks, and what expenses reduce income?

In this case, there are numerous risks for the investor, but the key risk is the risk of property depreciation. We are studying, for example, census data for a reason. While the share of foreign capital in the rental and purchase markets in some internal municipalities is increasing, many are experiencing significant population outflows. Whether there will be a significant increase in the total population of the district or a specific city, including due to foreigners, is an open question, despite all districts working to improve their investment attractiveness.

In this aspect, risks are lower in cities with more employment opportunities, such as Lisbon and Porto, for example.

If real estate is purchased with a mortgage, first of all, it becomes less profitable as you need to take into account the cost of the loan. The change in profitability will depend on the amount of the down payment and the number of years you want to spread the loan over. Secondly, you have the option to take out a mortgage with a floating, mixed, or fixed interest rate. The latter is still considered less advantageous, but if you understand that your family budget cannot withstand another jump, then perhaps this is your option. The cost of the loan in all cases is different, as are the risks. The recent situation with the increase in mortgage rates due to inflation caused by a series of catastrophic events, such as COVID-19, economic difficulties, and an energy crisis, and now a war, is an example of this. Banks evaluate their risks as higher, and they are also dependent on the increase in the European Central Bank's key interest rates. More information on mortgage loans in Portugal can be found on our website here, but it should be noted that the rates have changed since the writing of the article.

To calculate profitability more accurately, it is also worth considering the property purchase tax depending on whether you are purchasing as an individual or a legal entity, annual property tax, various municipal fees, and condominium maintenance fees.

Here is an example of calculations by APROP (Association of Portuguese Property Owners). For instance, a house is bought for 150,000 euros. The new owner then pays the following taxes: 1,859 euros for municipal property transfer tax (IMT), 1,200 euros for stamp duty, and 725 euros for notarization of the transaction. In addition to these expenses, there are annual property taxes (IMI) in the amount of 450 euros and 116.20 euros for municipal water charges. In practice, over 10 years, taxes and other charges amount to 9,446 euros.

It is worth noting that there are parameters that may change within the framework of measures taken in the "More Housing" package.

Additionally, it is possible to estimate periods of property vacancy, potential updates to appliances, and cosmetic repairs after each contract.

As of now, what is the situation with the government package of measures led by Prime Minister António Costa called "More Housing" ("Mais Habitação")?

Experts predict that the demand for rental housing will continue to rise in Portugal in 2023 for various reasons, but the supply of housing is already at a significantly lower level and does not meet the demand. To make it more profitable for homeowners and future investors to put their property on the long-term rental market, the government has presented a package of measures for discussion. More information on the package can be found in this document and on the program's separate website.

Here's what is known at the moment.

On March 16, 2023, part of the government program related to social support measures was approved. This concerns two decree-laws that establish emergency support and subsidization of rent, as well as subsidies for housing loans (mortgages). More information, including who is eligible and how subsidies are calculated, can be found here.

On March 30, 2023, the government approved a number of other measures from the package. This was preceded by public discussions, where the government collected proposals from all market participants, which can be found here.

- The government wants to provide land or public buildings under the Housing Construction Contract (CDH) for the construction, conversion, or renovation of real estate, which will then participate in the Rental Support Program (Programa de Apoio ao Arrendamento (PAA)).

- Funding of 250 million euros has been approved. The program provides for the approval of a credit line with mutual guarantee and subsidized interest rates for affordable housing projects, namely construction or reconstruction, as well as for the acquisition of real estate that must be placed on the rental market. Houses that will be built/reconstructed using this support will be transferred to the Rental Support Program for a period of at least 25 years.

- A whole package of tax benefits is provided, as well as fixing the rental price for real estate that will participate in the Rental Support Program.

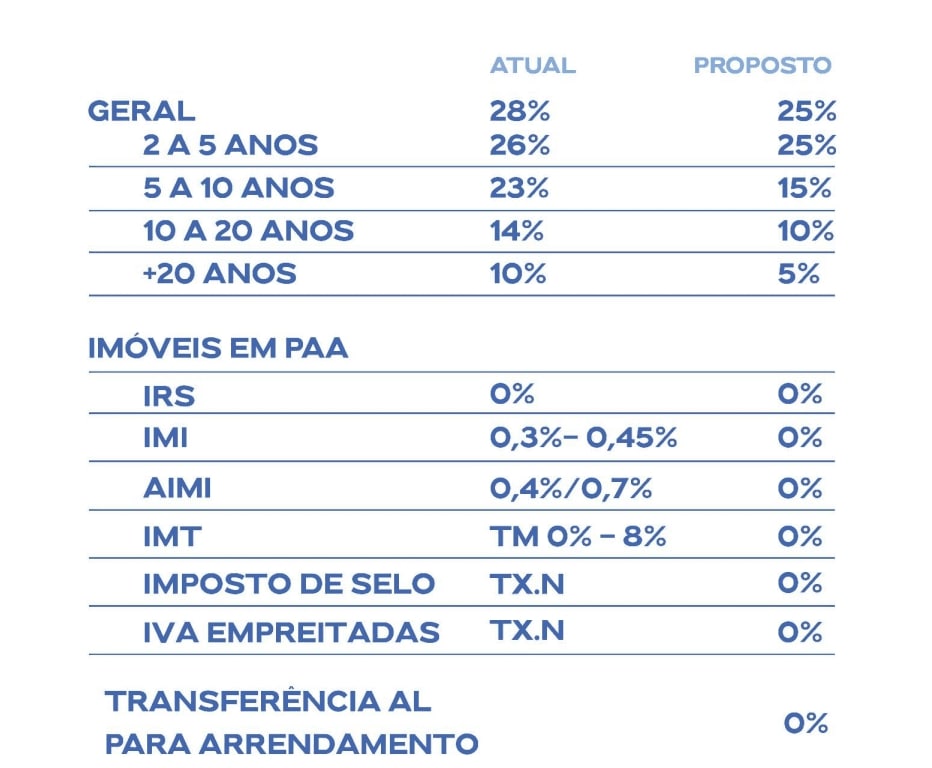

- The IRS rate is reduced from 28% to 25%. As the contract period increases, the rate will be reduced even more significantly. For a five-year contract, it drops from 25% to 16%, for a 5-10-year contract, it drops from 23% to 15%, for a 10-20-year contract, it drops from 14% to 10%, for a contract of more than 20 years, it drops from 10% to 5%.

- Exemption from IRS and IMI for real estate that will participate in the Rental Support Program.

- They have also provided for the stimulation of the transition of real estate from the tourist rental market to the long-term rental market. Real estate that will transition to the long-term rental market by the end of 2024 will be exempt from paying IRS on rental income until December 31, 2030.

- The government wants to create a branch that will combine the Service of Judicial Ban on Rent (SIMA) and the National Rental Service (BNA) to simplify procedures and coordinate the work of these mechanisms.

- The state will pay the landlord if the tenant is more than three months behind on payments, subject to certain conditions, of course.

- The issuance of new golden visas has been suspended since February 16, 2023.

- The period during which IMT will not be charged when purchasing real estate for resale is reduced from three years to one year.

- Compulsory rental of apartments that have been vacant for more than 2 years will be introduced.

More detailed information about all of these and other measures can be found in this article on idealista. Measures have been proposed for the tourist rental market, for houses with contracts dating back to the 1900s, and much more. It should be understood that all documents will be sent for discussion in Parliament. Whether all the new proposals will be approved and in what form is not yet known.

On April 27, 2023, discussions are expected on proposals to simplify licensing procedures.