Not so long ago we learned what taxes and other costs you will have to pay if you want to buy property in Portugal.

It's time to deal with the seller's side: what costs the owner incurs besides making a profit.

IRS tax on capital gains from real estate

If the property sells for more than you bought it, the owner's capital gain from the property appears. The 50% capital gain will be added as income to your other income when you file your IRS return.

But the taxable base can be significantly reduced. Let's look at how capital gains are counted and what can reduce taxes paid by the seller.

Capital gain = cost of sale - (cost of acquisition x currency depreciation ratio) - purchase and sale costs - costs incurred due to property appreciation (over the last 12 years).

In the formula we see the component Currency Devaluation Coefficient. The government publishes an annual table of currency devaluation coefficients. Therefore, for future years these values can be found in the public domain. In fact, these are the inflation values by which the value of the property is adjusted.

We can see that capital gains (and therefore the amount you will pay tax on) can significantly reduce the cost of buying and selling real estate, as well as the costs associated with home improvements. Let's decode these two values.

Costs of buying and selling real estate:

- Application to receive an energy certificate (about 20-70 euros, depending on the number of rooms);

- Land registration and related taxes;

- Stamp duty;

- Notary fees;

- Municipal Property Transfer Tax (IMT);

- Commission paid to the real estate company (if any).

This list is far from complete, and we go into more detail, for example, on the costs of documents at the end of the article. The main thing to understand is that such expenses reduce the amount on which you will then pay tax.

Housing Improvement Expenditures (in the last 12 years):

- Replacing windows;

- Сosmetic or major renovations;

- Installation of central heating.

And so on.

All expenses and fees for the last 12 years preceding the sale must be confirmed by invoices issued in the owner's name, so it is recommended to collect and carefully keep all documents at once, and it is better to indicate your NIF number when making settlements.

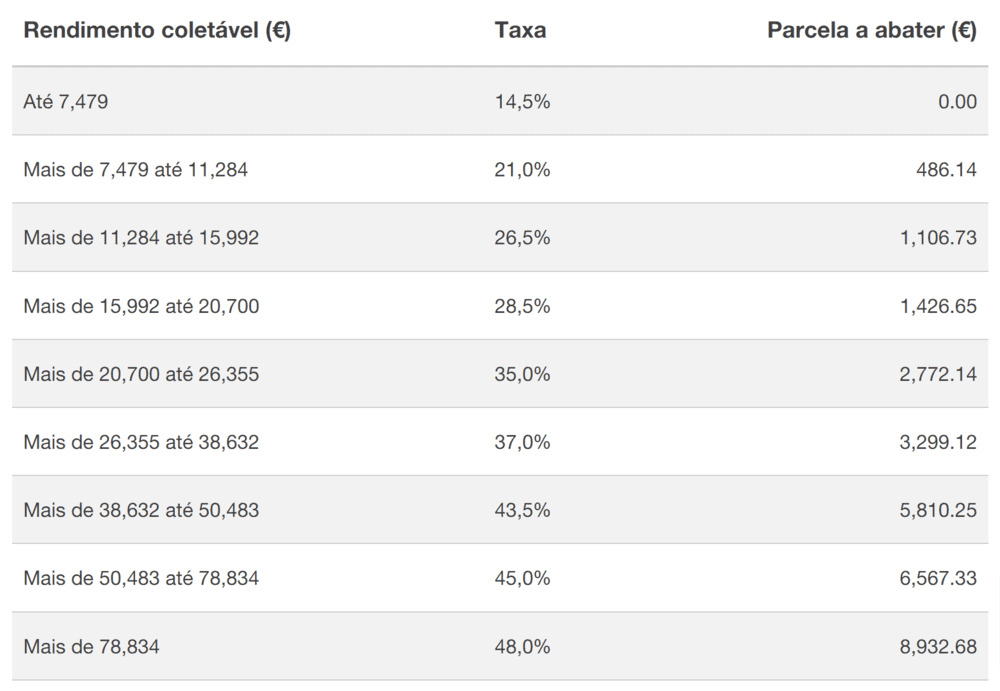

So, you've calculated the capital gain and you've taken into account all the factors that reduce your taxable income. This amount, as you wrote earlier, is divided in half and added to the rest of your income on which you will pay the IRS. The current annual rates for calculating the tax then apply.

For example, further rates for 2023 (source):

For example, you have calculated that the capital gain from the sale of real estate, taking into account all costs, was 50,000 euros, and your salary for the year is 24,000 euros. We divide the capital gain in half and add it to your other income. You have a taxable base of 49,000 euros. According to the table, a rate of 43.5% will be applied to it. That is, you will pay taxes of 21,315 euros. The calculations may also be adjusted depending on whether you are filing jointly with your spouse/partner, whether you have dependent children, etc.

It's important to understand that, first of all, some of the tax you paid can be refunded. Second, there are factors that can further reduce or even eliminate the taxable portion of capital gains from real estate, such as the fate of the profits from the sale, whether you are a senior citizen, and in what year you bought the property being sold. More about all of this later in the article.

Separately, it is worth mentioning owners who are not tax residents of Portugal. Previously, if you were not a tax resident, all your profits from the sale of real estate in Portugal were taxed at a flat rate of 28%. But in 2023 non-residents were equalized to residents in terms of the calculation of capital gains and the application of tax rates.

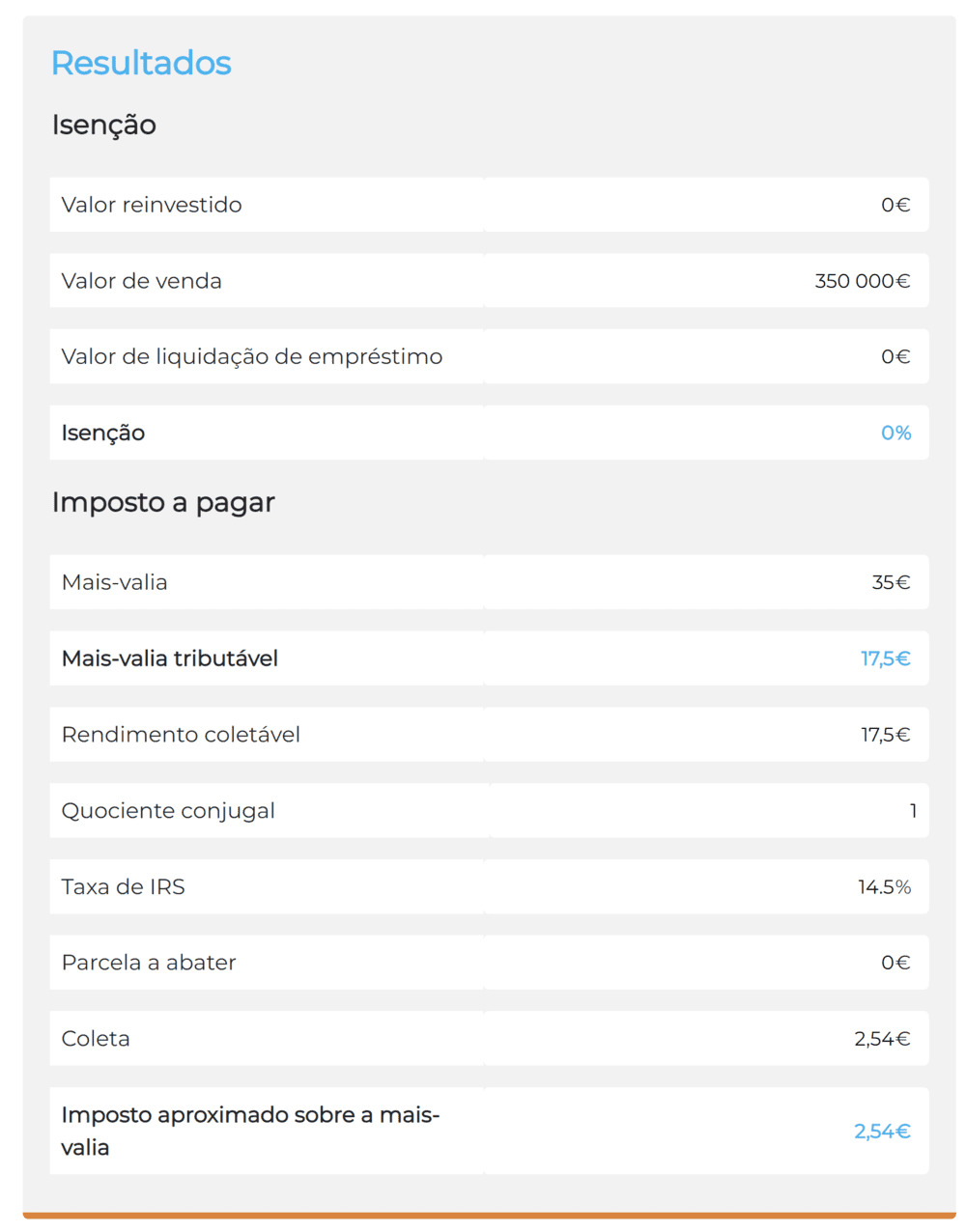

Online real estate capital gains simulators (Simulador de Mais-valias Imobiliárias).

It's worth noting that to save time, you can use online simulators to calculate capital gains and IRS tax. They can help you quickly estimate the tax you'll have to pay on the sale, taking into account all the key parameters. For example, this simulator.

In some cases, you can get an exemption from paying the IRS when you sell real estate:

- If you purchased the property before 1989, when the IRS Code went into effect. Although the IRS does not pay in this case, the sale must be declared on Schedule G1 (capital gains not subject to tax) when you file your annual tax return;

- If you sell your only home (own and permanent residence - habitação própria e permanente or HPP) and reinvest the profit from the transaction in the purchase of a new only home or even a plot of land for construction in Portugal.

Note that reinvestment must be made within 24 months before or within 36 months after the sale of the property in order to avoid paying IRS capital gains on the property. This includes why the sale must be reported on your annual tax return (Schedule G), where you also indicate your desire to reinvest the gain and the taxation of the capital gain is suspended until then.

If, on the other hand, you buy new property first, you can sell the old property within the next 24 months and notify the tax authorities that the money received from the sale was used for the property you bought.

Reinvestment can be used not only to buy new property, but also to expand or improve it. For example, you might decide to invest part of your capital gains to buy land and part to build a house on it.

Or you can reinvest part of the profit, then the IRS will only apply to the part of the profit that is not reinvested.

If the home being sold is a second home (such as a vacation home), the reinvestment regime cannot apply, and therefore you will need to pay the IRS on half of the capital gain.

- If you decide to reinvest the money from the sale of your only home in Portugal into another EU-only residence (there may be some additional costs in this case).

Owners over 65 may be exempt from IRS on capital gains

To qualify for this exemption, the seller of the property over the age of 65 must reinvest the profits from the sale in a Ramo Vida financial life insurance contract or an open retirement fund that provides a regular periodic income. For reinvestment within 6 months of the transaction, a public financing system including pension certificates (or RPCs, more on that here) is also suitable.

This option also applies to your spouse or partner.

In the case of financial life insurance or individual open retirement fund membership contract, the terms of the contract must provide regular and periodic benefits to the estate seller or spouse/partner for a period equal to or greater than 10 years, with a maximum annual amount equal to 7.5% of the investment amount.

To activate this option for yourself, you must specify the amount invested in these instruments (in Appendix G of the Tax and Customs Organization website).

There are quite a few nuances here, so in any case we recommend that you seek further advice from either CNAI or AT.

If you sold real estate cheaper than you bought it

It also happens that the owner sells the house cheaper than he bought it before and suffers a loss. You must notify the AT (Internal Revenue Service and Customs). In this case, there is no basis for paying the IRS.

Moreover, the amount of the loss can help reduce your taxable base if you sell another property at a profit. The taxable basis can be the difference between the profit and the loss.

If you sold real estate for less than the value of the tax asset (VPT: Valor Patrimonial Tributário)

We remember from the article about buyer's costs that the VPT is independent of the property owner and is automatically set by the Ministry of Finance every three years.

It may happen that you have sold a property below the VPT value. In this case, you will need to provide a lot of proof through the AT portal. For example, a copy of the contract of sale, deed of acceptance of the property, a copy of the advertisements, bank information about transactions in the transaction, etc.

If you do not provide this evidence, the taxable amount of the capital gain will be calculated based on the VPT value.

Real estate agency commission (Comissão da agência imobiliária)

If you resort to the agency's services, they are likely to cost you around 3%-5% (+ VAT) of the price specified in the act of sale. However, it's worth checking with each agency for their fee. Payment in full is made when the parties have fulfilled all the terms of the contract, according to Portuguese law. But the payment schemes may be different. For example, 100% payment at the time of the finalization of the deal. Or, for example, a 50% deposit upon signing the contract with the agency, and the remaining 50% after the completion of the transaction for the sale of real estate.

It must be said that according to our observations, quite a small percentage of real estate is sold in Portugal without an agency. The agency takes on a lot of fairly complex tasks, such as checking the seller and the buyer, organizing the entire process of the transaction, collecting all necessary documents, finding clients, organizing viewings and so on.

On our website you can also find realtors in Lisbon, Porto, Madeira and other locations in Portugal to help you with the purchase or sale of real estate.

Nevertheless, if you have decided to sell the property yourself, these recommendations from idealista may come in handy.

Mortgage waiver (Cancelamento da hipoteca)

If you are selling a property purchased with a mortgage that is still outstanding, you must formally cancel the mortgage so that the home is available to the buyer.

In this case, the application for registration of the waiver of mortgage must be accompanied by an application for registration of the contract of sale of the property, and possibly, if there was one, information about the conclusion of a new mortgage contract already by the buyer. Such a waiver procedure at the Land Registry costs about 50 euros.

Additionally, you need to find out about the terms of the mortgage waiver at your bank.

Expense for document flow (Despesas com documentação)

From the article about the costs of buying a residential property, we know that notary fees are the responsibility of the buyer, as well as the costs of some of the documents required to obtain a mortgage. On the seller's side, there are also costs associated with the transaction paperwork.

- Certificate of permanent ownership (Certidão predial permanente). The cost is 15 euros when ordering online, and 20 euros when ordering at the Cadastral Office (Conservatória do registo predial), the Citizen's Shop (Loja de Cidadão) or the Registry (Espaço Registos). This is the cost per share of the property. Read more here. The document is valid for 6 months. This certificate contains all the basic information about the property, including the owner's details. It is required, among other things, to ensure that the buyer is certain that the seller is the rightful owner of the property and whether there are any additional conditions, such as a mortgage, which is not yet known.

- License for use (Licença utilização). Costs from 35 euros. The presence of this license confirms the suitability of the property for habitation. Any property intended for habitation must have a housing license issued by the city council of the place where the property is located. Many municipalities allow you to order such documents online, for example, Lisbon. Under the exception to the rule are houses built before 1951. In the case of the sale of such real estate license is not required. Also, a license is not required if the property is sold uninhabitable.

- Technical sheet / housing passport (Ficha técnica habitação). Costs from 130 euros. Since you have bought a property that you are now selling, you should already have this document in your possession. But if for some reason it does not exist or it is lost, it can be requested from the builder (he must keep the document for at least 10 years) or the City Council, subject to the payment of a fee. You can see an example of such a document here. The FTH is a descriptive document of the technical and functional characteristics of a city building. All buildings constructed or renovated or remodeled after March 30, 2004, must have this FTH. The Certificate of Acceptance for your real estate transaction cannot be signed without first having this document certified by a notary. Therefore, FTH, as well as the rest is worth preparing in advance, so as not to delay the transaction and not to lose the buyer. And there is an exception to the rule on the need for the seller to provide this document. Buildings with a residential license applied for or issued before March 30, 2004 and buildings constructed before August 7, 1951 do not require an FTH.

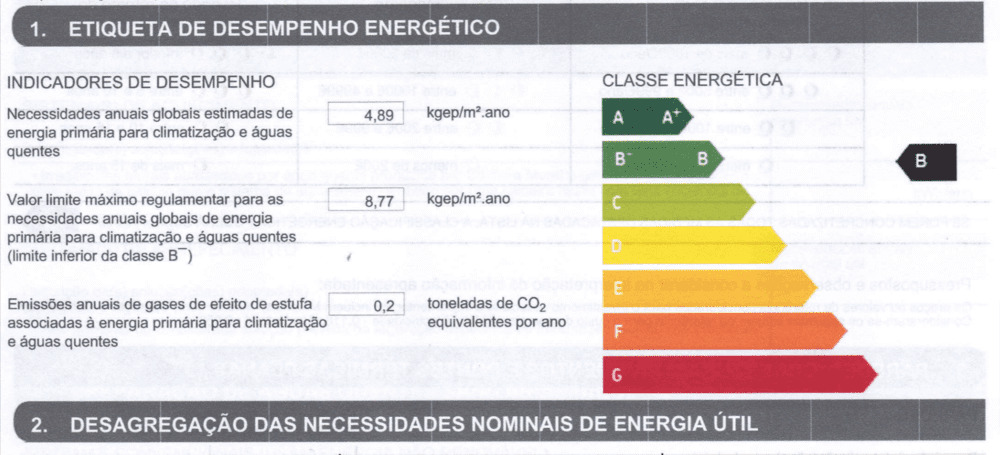

- Energy certificate (Certificação energética). Since 2013, this document is mandatory for the sale of real estate. The cost ranges from 20 to 70 euros. The validity of the document varies depending on the type of certificate and the building. For residential buildings and small commercial and service buildings, it is 10 years. The certificate can be ordered from a company that is recognized by the Energy Agency (ADENE). If you put your house for sale without having this document with you, you can be fined between 250 and 3740 euros.

We have tried to provide you with the basic and most complete information about the owner's costs of selling their property. If your transaction takes place much later than the date of this article, we recommend that you additionally double-check the nuances based on your existing knowledge. For example, the conditions for non-residents that we wrote about changed in 2023.

Translated from Ukrainian by Rodion Shkurko