Many people consider buying an apartment or a house in Portugal to live in. Depending on their budget, they filter through the offers. It's useful to understand that if you are aiming at your maximum budget, it should also include the main taxes that you will have to pay when purchasing residential property.

In this article, we will tell you about the main additional fees that you will need to pay on top of the cost of housing.

Municipal property transfer tax (IMT)

The first tax that you will think about paying is the IMT. It is paid only once after the completion of the property purchase procedure. The amount you pay will depend on three factors:

- the value of the property according to the contract or the value of the taxable asset (VPT: Valor Patrimonial Tributário), whichever is higher;

- the location of the property;

- the purpose of the purchase (sole residence, rental property, etc.)

Let's figure out which value of the property cost will be applicable for the IMT calculation. To calculate the tax, the larger of the two values is taken: either the cost specified in the sales contract or the value of the tax asset (VPT). The first one is clear, we believe.

And what is VPT? VPT does not depend on the property owner and is automatically established by the Ministry of Finance every three years.

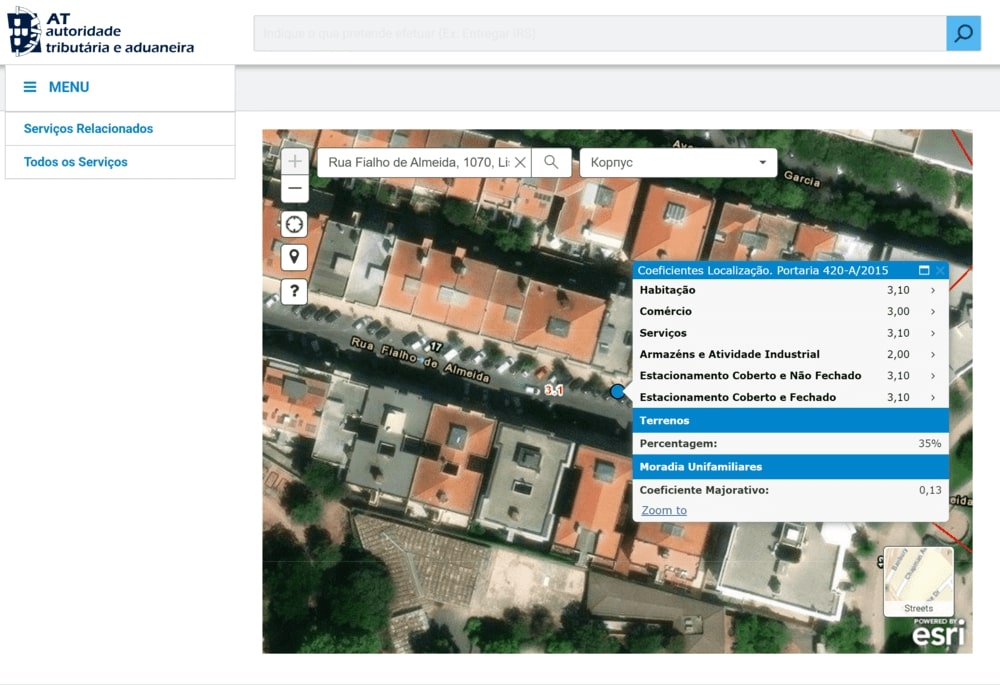

How to find out VPT? To do this, you need to go to the SIMIMI simulator (Simulador de Valor Patrimonial Tributário) from the Tax and Customs Authority (AT: Autoridade Tributária e Aduaneira).

First, on the map, you search for the address of the property and select the building of interest.

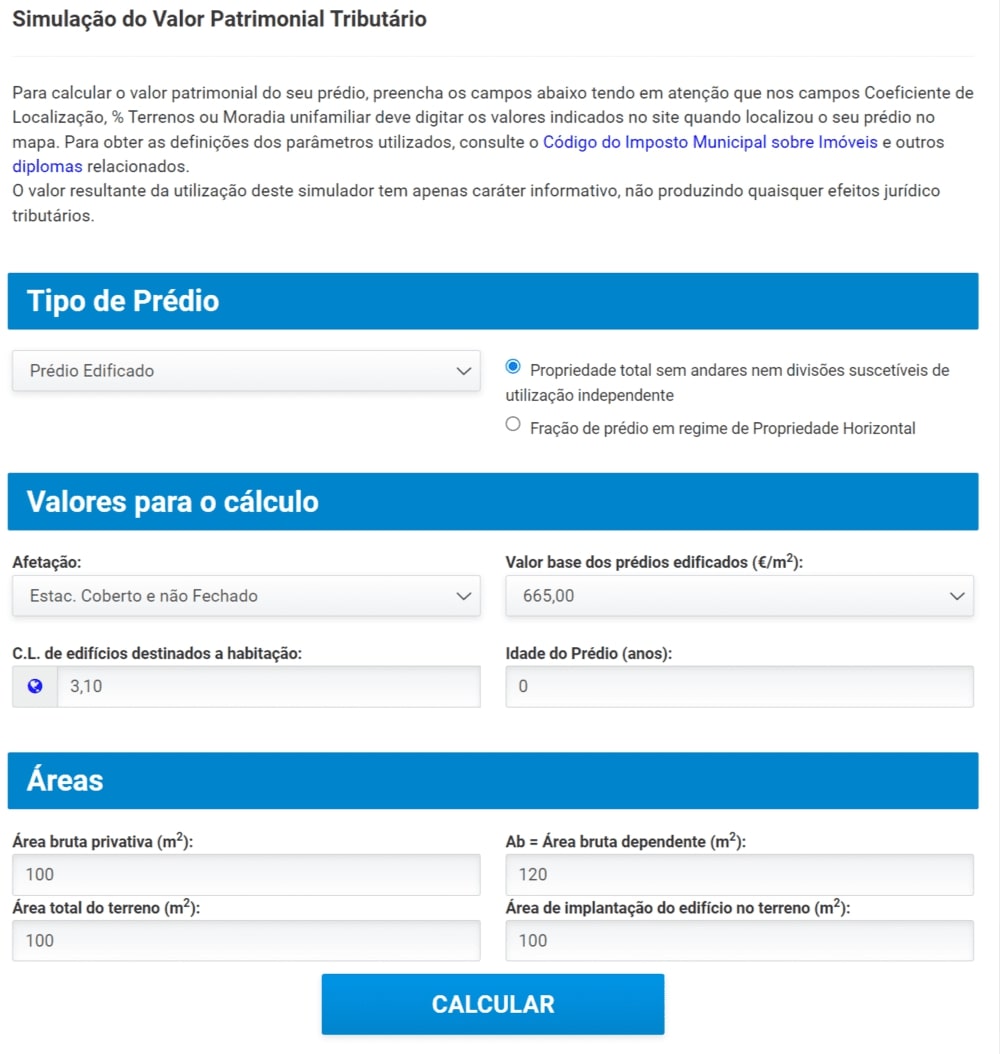

Then, you click on any row of the table that appears, enter all the requested data, and press the Calculate button (Calcular). Not all of the data may be obvious, so the property seller or real estate agent may be able to help you with the values of some of the rows.

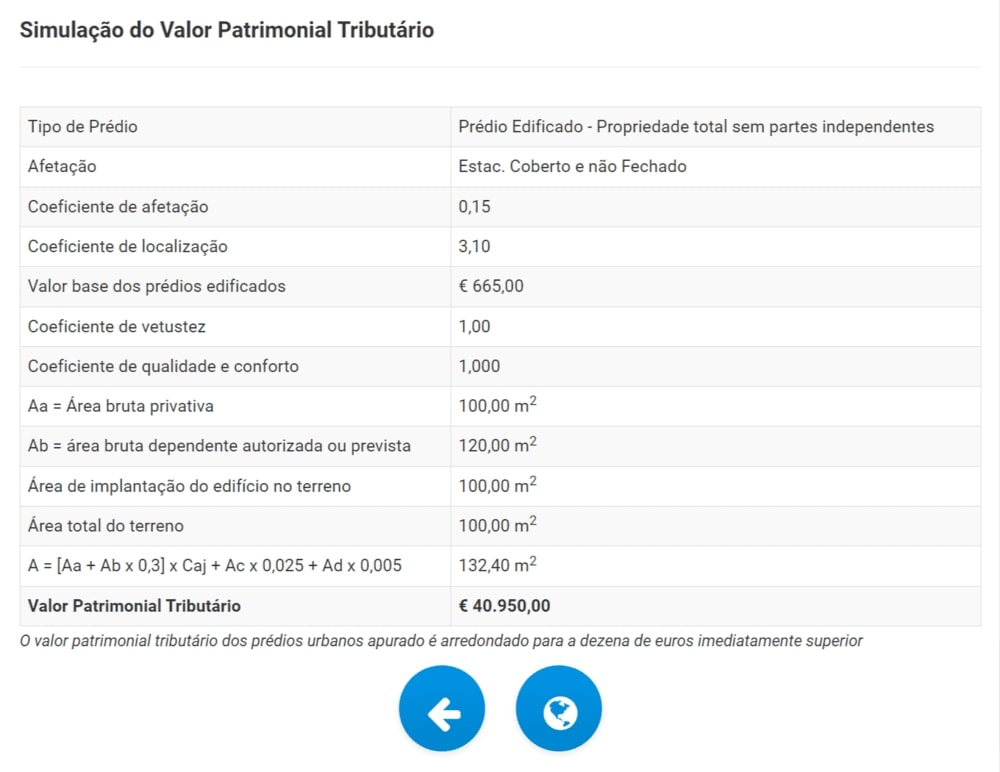

This way, you obtain calculations and the value of VPT:

A simpler way to find out VPT can be to obtain the Predial Booklet (Building Booklet) document, which is issued by the Tax and Customs Authority (AT) and is available to every property owner (or the owner can request it online), it is essentially the property's passport. The document contains all the characteristics of the property, the owner and their details, as well as the VPT value. This document will also be required if you plan to apply for a mortgage to purchase the property, as well as to obtain an energy performance certificate or to sign contracts for water/electricity. You can read more about the Building Booklet here, and there is also a video from the Tax and Customs Authority showing how to order the booklet online if you are already a property owner.

If you have all the necessary information, you can use any available IMT simulator, such as this one, to calculate the tax. For example, when purchasing a property for personal use in the mainland part of the country for 350,000 euros, the current tax will be 15,437.94 euros. Similar property in the Azores will have an IMT of 12,568.50 euros. We recommend checking when the calculator was last updated, as some other websites we tested relied on old percentage rate values.

If you want to calculate the tax yourself.

Below is a table showing the interest rates used in 2023 to calculate IMT when buying a home to live on the mainland. Online calculators also use them.

If the property you buy is worth less than 97,064 euros, such property will be tax free.

Suppose we want to buy a house for 350,000 euros, the calculation would look like this: (350,000 * 8%) - 12,562.06 = 15,437.94.

The same tables exist for real estate intended for other uses.

A similar table for autonomous regions:

As you can see, here the minimum property value threshold at which no IMT tax will be charged is different. Again, if we want to buy a property here for 350,000 euros, the calculation will look like this: (350,000 * 7%) - 11,931.50 = 12,568.50.

Now you understand how the digital calculator calculates all these indicators, and you will always be able to verify whether the calculations are correct.

It is important to note that due to the new measures proposed by the government as part of the More Housing ("Mais Habitação") program, which we discussed at the end of this article, changes are being introduced in the conditions for paying taxes, including IMT. However, these measures mainly do not apply to properties purchased for personal use.

Stamp duty (Imposto de Selo)

Typically, the amount of the fee is immediately indicated in the calculations in the online IMT calculator.

As of now, the IS is 0.8% of the amount specified in the Acceptance Act.

For a property worth 350,000 euros the tax will be 2,800 euros, regardless of the purpose of the acquisition and the location of the property.

This is one of the oldest taxes in the Portuguese tax system, which has been in existence since 1660. The stamp duty is not only levied in real estate transactions. It is also applied to securities transactions, gifts of property, various customs operations (for example, if you order goods from China), and consumer and mortgage loans. The last point is also important in the context of this article. If you use bank borrowings (mortgage loan), you are also required to pay stamp duty for the use of the loan:

- if the loan is taken for a period of 1 to 5 years, the rate is 0.50% of the loan amount;

- if for a period of more than 5 years, the rate is 0.6% of the loan amount.

In this case, the stamp duty is charged as soon as the loan amount is available in your current account. It should be noted that the government is trying to encourage households to pay off their mortgage loans early. Thus, if early repayment is made by families by the end of 2023, they are exempt from bank fees that are usually charged for early repayment of the mortgage, as well as from stamp duty on this fee (and not on the amount of the loan provided), more details can be found here.

The good news is that the interest on loans provided for the purchase, construction, or renovation of one's own permanent or secondary housing is exempt from stamp duty.

Municipal property tax (IMI)

Unlike the previous two taxes, which are paid on a one-time basis, this one will be assessed every year in May.

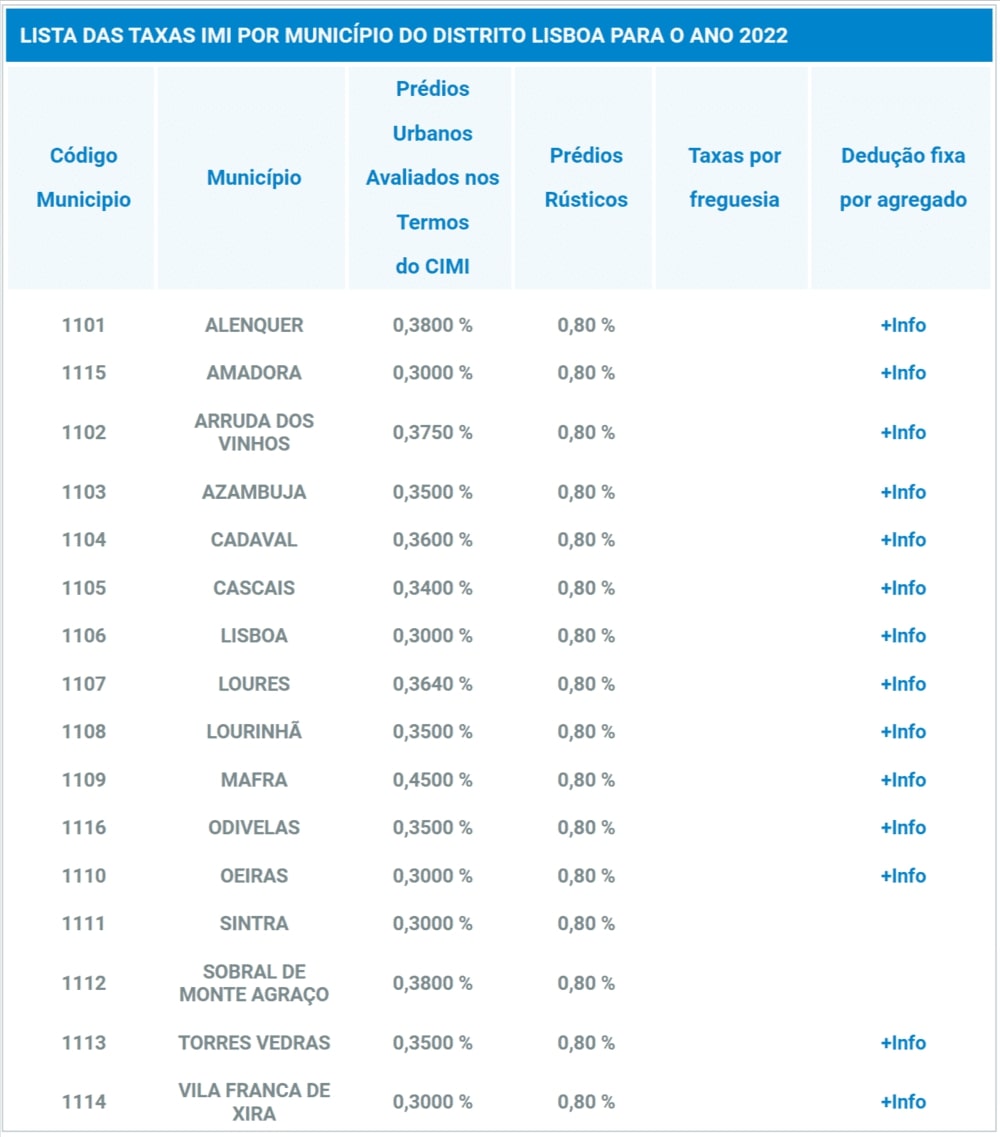

The percentage of the tax is determined by the municipality where the property is located. The amount of this tax is updated annually, with the government setting the maximum and minimum limits. The final IMI rate is determined by each municipality. This tax is one of the sources of their income.

There are many online calculators to calculate the amount of tax. For example, this one.

To understand the rate at which you will pay tax on the property you buy, you can enter the data (year and area) on the financial portal.

This, for example, is what the rates look like for Lisbon County in 2022 (on which the May 2023 assessments were conducted for 2022). The third column shows the rate for urban structures and the fourth column for rural structures.

IMI is calculated from the already familiar VPT amount. In addition to the VPT, the city where the property is located, and the type of real estate (the latter two affect the rate), it is important to specify the number of children in your family (up to 25 years old and without income). This will allow you to get a tax discount:

- 20 euros, for those with one dependent child;

- 40 euros for those with two dependent children;

- 70 euros, for those with three or more dependent children.

If the IMI value is up to 100 euros, you must make full payment in May. If the amount is between 100 and 500 euros, you can pay the tax in two "monthly payments": one in May and the other in November. If the IMI value exceeds 500 euros, the taxpayer can make this payment in three installments: May, August, and November.

Let's say that according to your Building Booklet, your future property in Lisbon costs 250,000 euros, and you do not have any children. Currently, your IMI will be 750 euros. Since the tax value exceeds 500 euros, you can divide the payment into 3 installments of 250 euros in May, August, and November.

Additional expenses

In Portugal, it is the buyer who pays the costs associated with the transaction. Depending on the type of notary (public or private) and the availability of mortgage lending, the cost can vary between 400-800 euros per deal.

In addition, if you want to make sure that the seller sells the house only to you, it is important to request a temporary (preliminary) registration. It may cost about 250 euros to order such a document from the Land Registry.

It is also worth finding out what the monthly condominium fee is if you are buying an apartment in a multi-apartment building. These expenses are not related to the transaction itself, but the amount varies from 40 to 150 euros (depending on the area, common areas such as pools, etc.), and can become an important factor in choosing a property.

If you use bank financing, you additionally have the following expenses:

- the cost of the pre-registration document. In the case of a mortgage, this document will be mandatory;

- bank charges;

- stamp duty on the amount of the loan;

- the cost of obtaining a mutual registration document with the mortgage (about 370 euros);

- life insurance. The premium for this insurance is calculated based on the sum insured and the age of the policyholders.

In this article we have outlined what costs are paid by the buyer of the property. Later on we will tell you about the costs for the seller of a property in Portugal.

Translated from Ukrainian by Rodion Shkurko