In this article we will tell you what salary withholding is; who can perform it and in what cases; how it is calculated; what to do in case of withholding and what exceptions exist.

Even if a person plans their family budget very properly, there is always the possibility that unforeseen circumstances may force them to fail to make necessary payments on time or take out a loan that will be impossible to repay on time. An unexpected illness, equipment or car breakdown, being laid off from work, mistakes in investments can destabilize a family's financial situation and lead to salary withholding when the family cannot repay debts on time. Looking ahead, it is worth saying that withholding is partial because there is an inalienable portion. And the measure of withholding is an extreme coercive action if all other ways of resolving the conflict do not work.

What is salary withholding?

A salary garnishment or partial seizure of assets is a judicial seizure of a debtor's salaries that aims to satisfy the claims of a creditor, be it a private individual, a commercial company or public authorities (e.g. tax office, social security system). If you would like to study on your own the details of the legislation that regulates this process, Article 738 of the Code of Civil Procedure (art.º 738º do Código de Processo Civil) will help you.

Steps for debt collection

Below, we briefly describe the process from the time the creditor self-reclaims the debt to the repayment of the debt through litigation and seizure of salaries or other assets.

- Pre-trial Settlement.

The creditor will always try to settle the debt directly by sending reminders, organizing negotiations or offering to restructure the debt. As we wrote earlier, initiating court proceedings is a last resort. This is also because the litigation process is long and expensive.

- PEPEX (Procedimento Extrajudicial Pré-Executivo or Extrajudicial Pre-Executivo Procedure).

This is an optional step, but it helps the creditor find out if the debtor has assets. Depending on the result, the creditor can decide to go to court or not, or change its collection strategies. The PEPEX process is accomplished by filing an application through the bailiff (Agente de execução) and the Citius platform.

- Trial (Ação executiva).

If the creditor decides to initiate legal proceedings, the process begins with the filing of an enforcement action (ação executiva) with the court. If the court results in a judgment of recovery, a bailiff (agente de execução) is appointed to carry out the recovery procedure.

- Notice to Debtor.

The bailiff notifies the debtor of the commencement of enforcement proceedings and the need to repay the debt. The debtor may have a certain amount of time to voluntarily repay the debt or to object to the execution (oposição à execução).

It is only at this step that the process to which this article is dedicated begins. If the debtor does not voluntarily repay the debt or does not file an objection, the search, and seizure of assets begins.

The employer is notified of the need to withhold an amount corresponding to the withholding amount set by the court. This amount is then transferred to a bank account under the control of the bailiff. The money must remain in this account until the deadline for objecting to the withholding expires.

At the end of this period, if there are no objections, the bailiff transfers the amount to the creditor and notifies the payer to transfer future payments directly to the creditor. This procedure is carried out on a monthly basis. Each month, part of the debtor's salary is sent to the creditor. However, it is worth taking into account that there are some restrictions on this forced collection of debts, about which we will tell further.

Banks where the debtor has savings or savings accounts may be notified in the same way.

- Sale of seized assets.

If there are insufficient or no withholdings from salaries (e.g., if there is no job), then a sale of assets is initiated, for example, through an auction. The funds from the sale go to the creditor.

- Termination of enforcement proceedings.

When the debt is fully repaid, the bailiff finalizes the enforcement proceedings and notifies both parties. If the assets sold are insufficient for full repayment of the debt, enforcement proceedings may be continued until full recovery or until the impossibility of further recovery is recognized.

If the debtor has multiple bad debts, a waiting list will be created, with the debts corresponding to the earliest notification dates at the top of the list. However, priority will be given to debts related to alimony.

Important rules when withholding salaries.

- A debtor by law must always have a part of his or her salary left to live on. The maximum part that can be seized is one third of the entire salary after taxes and social contributions have been deducted.

- At the same time, the debtor must be left with an amount not lower than the national minimum salary, which is 820 euros for 2024.

For example, if your net salary is €1,500 per month, only one third of this amount can be withheld, i.e. €500. This would leave €1,000, which is more than €820. But if the salary is, for example, 900 euros, only 80 euros can be withheld, so that the person is left with at least 820 euros.

The rule does not work in the case of alimony, see further down the line.

- On the other hand, if the salary is high enough and after withholding the debtor is left with an amount exceeding three minimum salaries (i.e. €2,460 for 2024), the withholding will be increased by the amount of the excess in order to pay the creditor sooner.

For example, if the net salary is €4,000, one third can be withheld, i.e. €1,333. However, after withholding there will be 2667 euros left, which is more than 2460 euros. In this case, the withholding will be increased so that you are left with no more than 2460 euros, i.e. 2667 euros minus 2460 euros equals 207 euros. The final amount of withholding will be €1,540.

- Premiums, meal allowances, vacation pay, Christmas pay, pensions (including survivor benefits), insurance payments, accident compensation, etc. fall under the withholding amount.

It is important to remember that if the person who owes believes that the amount exceeds the legal limit or other injustice occurs, the person can object through the court to the withholding.

All of the above rules have exceptions.

In some situations, the debtor may not be subject to salary withholding.

Here are some of those situations:

- If a person is paid the minimum salary or less, they are exempt from withholding because the withholding percentage only applies to the amount above the national minimum salary;

- If the debtor works part-time, there is no withholding and the process ends in uncollectibility;

- If the debtor is unemployed, the same thing happens. There is no withholding, the process ends with impossibility of collection (because there is no income);

- If there is a debtor's bankruptcy filing;

- If the debtor emigrates and has no income in Portugal, as recovery abroad is not possible.

In the case of child support arrears, an amount equal to the full social pension under the non-contributory scheme remains untouchable. This is a scheme where benefits are paid regardless of whether a person has contributed to the scheme before. In the context of the article, this refers to the social pension that is paid to people who do not have enough years of service or have not contributed to a pension fund. In 2024, this amount is 245.79 euros. About the pension in Portugal, we wrote in this article. That is, if the debtor's salary is equal to the national minimum salary of 820 euros (for 2024), the amount of 245,79 euros is inviolable, and 574,21 euros can be used to pay alimony.

How to calculate payroll withholding.

As mentioned earlier, payroll withholding is calculated based on net pay, which is the amount after mandatory tax and social security deductions.

Steps to calculate the deduction:

- Calculate your net salary (deduct all taxes and social security benefits from the monthly amount).

- Divide the resulting amount by 3. The resulting number is the amount of withholding.

- Deduct the amount you receive from your net pay. This is the amount you will have left after deduction. Next, as we wrote earlier, you need to check if the amount after deduction is between the Portuguese minimum salary (€820 for 2024) and three Portuguese minimum salaries (€2,460 for 2024). If the amount is in this range, the deduction amount will remain as you calculated. If not, see the examples of reducing or increasing the deduction amount we gave above.

Once the salary withholding amount is calculated, it will be deducted monthly until the debt is paid in full.

You can also use the calculator from the Colégio de Especialidade dos Agentes de Execução to calculate the amount.

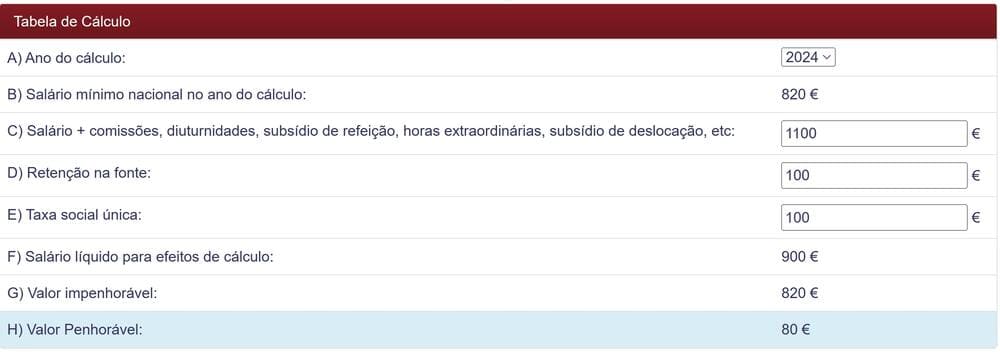

Text in the image:

- Calculation Year: 2024

- National minimum salary in the reference year: 820 euros

- Salary + commissions, seniority payments, meals, overtime, travel expenses, etc.: 1100 euros

- Withholding tax: 100 euros

- Single social contribution: 100 euros

- Net salary for calculation purposes: 900 euros

- Non-recoverable value: 820 euros

- Confiscation value: 80 euros

Rights of the debtor in withholding salaries:

- Reducing the amount of salary garnishment.

A person may apply to the court with a request to reduce the withholding from 1/3 to 1/6 of the salary. The request may be granted due to the life circumstances of the debtor and his/her family, the nature, and amount of the debt; and the reduction may be maintained for a part of the time necessary for the debtor to repay the debt. It is even possible that the salary withholding may be waived for a period not exceeding one year.

- Canceling the hold.

The debtor may object to the withholding of salaries, as such, or to the amount ordered. This applies in cases where there is a contradiction with the law. For example, the amount withheld leaves the debtor with less than the national minimum salary.

- Suspension of the executive process.

The debtor has the right to file an objection to the execution within 20 days after being informed of the initiation of enforcement proceedings. Thus, there is an opportunity to appeal the entire enforcement process and suspend the withholding of salaries.

- Eligibility for PEAP measures.

PEAP (Processo Especial para Acordo de Pagamento or Special Process for Payment Agreement). It is a legal mechanism in Portugal that allows debtors in economic distress to negotiate with creditors to restructure their debts. Under PEAP, measures such as extending payment terms, reducing interest rates, providing guarantees and partial forgiveness of principal can be offered. The process is designed to help debtors restore their financial health and prevent bankruptcy, and it must be approved by the court and agreed to by creditors.

- Declaring bankruptcy.

If a person is unable to pay all debts due to difficult circumstances in life, he or she has the right to file a declaration of personal insolvency (bankruptcy) requesting relief from financial obligations for debts. Upon declaring bankruptcy, all enforcement proceedings from private creditors, tax enforcement processes, and expected seizures of the debtor's assets may be suspended or discharged.

If a person is declared bankrupt, his or her assets are used to discharge debts as part of the bankruptcy process. These assets can be: house, land, car, motorcycle, computer, chairs, cabinets, televisions, cameras, fur coats, jewelry, artwork, savings certificates, rent and investment interest.

It is worth noting that the family dwelling, which is the debtor's only home in many cases is protected (habitação própria permanente or own permanent dwelling). For example, in the case of debts owed to tax authorities and social services, the family home will be protected by law, but this is not the case for debts owed to private organizations, individuals and banks. It is possible to see the family home confiscated for a debt of, for example, 600 euros for telecommunications. Also, if the tax value of the property equals or exceeds 574,323 euros, the protection does not work either.

Depending on the situation and the law, the remaining outstanding debts may be canceled, which is called "exoneração do passivo restante" (release of the remaining debt).

This article was about salary garnishment for failure to fulfill all sorts of outstanding financial obligations, but we will mention loan obligations separately. Remember that it is better not to take on credit obligations that you most likely will not be able to fulfill. Although, you should not be afraid of loans if you have a stable job. Unfortunately, even if difficulties arise unexpectedly and lead to default, this situation can negatively affect your credit history. This may become a barrier to obtaining, for example, a mortgage loan or any other loans from any local banks.

Even non-payment of regular or large arrears on telecom bills can lead to refusal to contract with other similar companies in the future, as information about debtors is collected in separate closed databases to which telecom companies have access.

We hope you never find yourself in the situations described above, but if you do, you can contact our attorney.