Thinking about buying real estate today, we can assume that we are in the midst of a price boom; the market is looking for a balance point but is still unable to find it. Also, regarding rent, not everything is so smooth: the acute shortage of offers, tenants require up to 1 year of prepayment and several deposits, and prices have risen decently (we'll talk about them separately below). We can state that the Portuguese real estate market is a seller's market, not a buyer's – no matter what deal you start, whether buying or renting, you won't be the one choosing. Alas, this is the current reality.

Representatives of major real estate agencies, analysts, and Portuguese government officials have recently made many statements, conclusions, analyses, and predictions. In this article, I will try to outline the main thoughts on this subject, and the reader will be able to draw their conclusions.

Factors influencing the real estate market

Undoubtedly, global macroeconomic and geopolitical factors affect the vulnerable and instantly responsive real estate market. And Portugal is no exception. To understand the nature of the fluctuations, we have to get into the economy, politics, and other areas. Therefore:

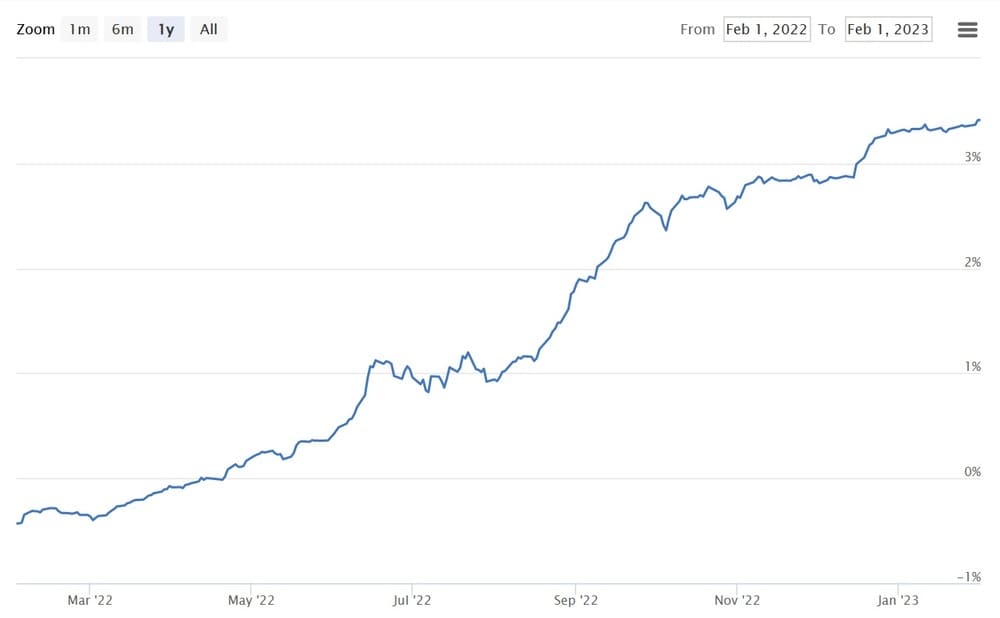

Factor #1 – Inflation: not apparent, not visible to the naked eye, but actively heating the market – inflation and, as a consequence, the increase in EURIBOR rates (Euro InterBank Offered Rate, the European average interest rate on interbank loans provided in euros). It makes mortgage loans less affordable and attractive and complicates the life of "lucky" loan holders with a variable rate. Nevertheless, according to Banco de Portugal, more than 90% of mortgages in Portugal have an effort ratio below 27% and a monthly payment below €470. The effort ratio, in short, is how much of a family's monthly income goes towards monthly payments.

The real estate sector is strongly affected by the instability of the global economy: according to the Organization for Economic Cooperation and Development (OECD), global economic growth in 2023 will slow to 2.2% and in 2024 will recover only to 2.7%. The ubiquitous rise in inflation (in Portugal, it was about 8% in 2022) also plays a cruel joke, though it is expected to decline in the next 2 years.

Concluding the inflation theme, we refer to the ECB (European Central Bank), which notes that low-income households will be the most affected. Rising inflation and interest rates can make it impossible for these families to pay their debts, which could lead to default.

Factor #2 – Immigration: more obvious, but we don't look at it from all sides. The trend of immigration to Portugal is increasing, particularly from wealthier countries. It is a standard process, as the flow of immigrants from various countries has never weakened.

The rapid growth of foreign settlers leads to the fact that the Portuguese are now very concerned about the problem of price fluctuations in the real estate market because of the sharp rise in rental prices and a slower but equally steady increase in the purchase price, with very little indexation of wages, affects the locals primarily. Unfortunately, the Portuguese are increasingly thinking about how to live in their cities, and many have stopped being able to do so financially. Take, for example, the figures in Lisbon and Porto, from which the impossibility of buying your own home becomes apparent: the minimum wage in 2023 is €760, the average salary is €1379, the average price in Lisbon is €5116 per m2, in Porto – €3276 per m2.

According to Engel & Völkers Lisboa, although the Portuguese, accounting for about 75% of the market share, are the most substantial group of buyers in Lisbon, the number of foreign buyers is steadily growing. Presently, foreign investment in Portuguese capital already accounts for 25%. After the pandemic, the number of foreigners in Portugal has not stopped growing. In the property market, including "luxury," the main stakeholders are the citizens of Brazil. Next are buyers from North America, Germany, Britain, and France.

Hand on heart, it is worth noting that the purchase of real estate by foreigners is insignificant in terms of transaction quantity and occurs mainly in the high-end segment. It is a demand that does not compete with the vast majority of Portuguese families.

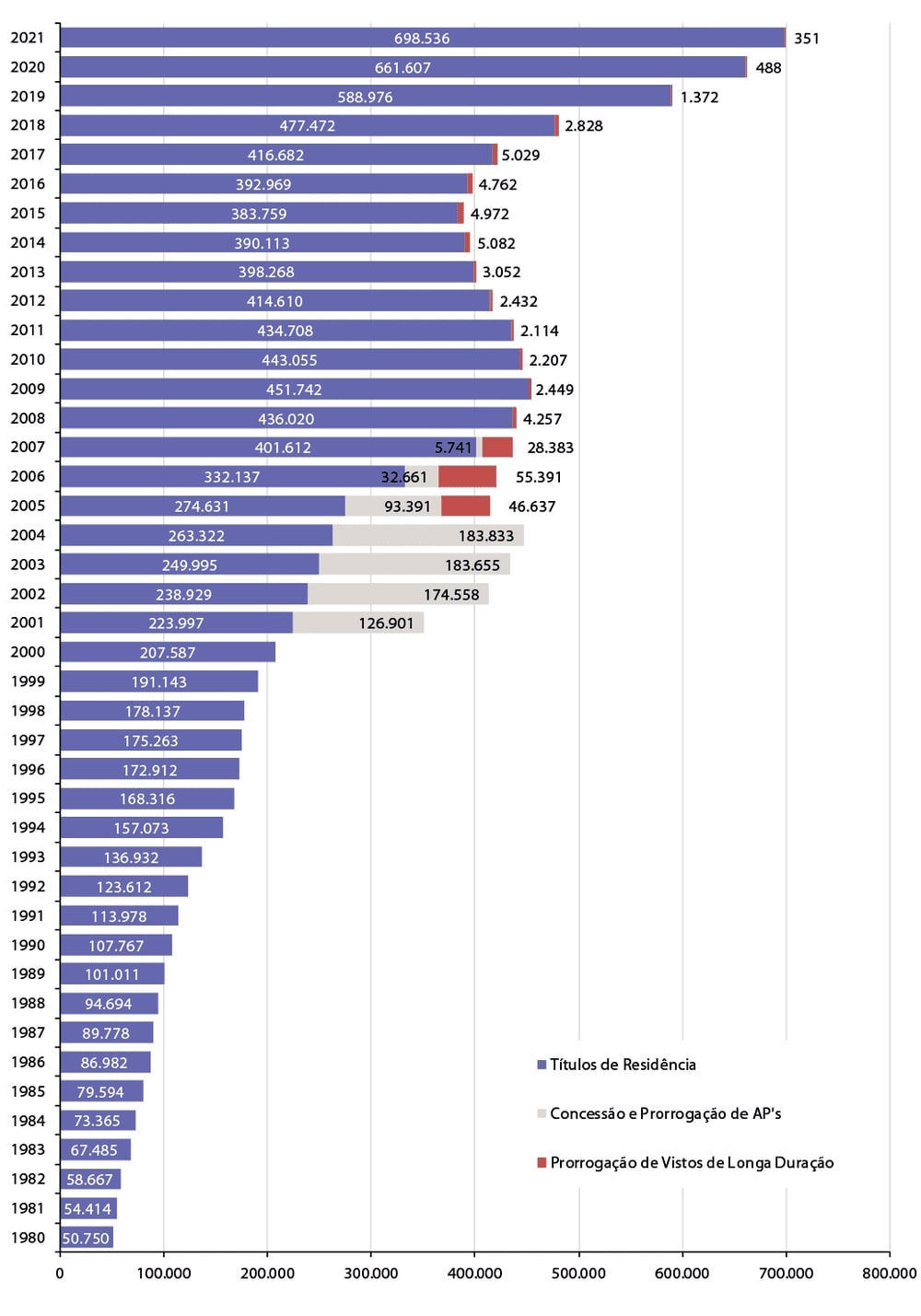

Let's briefly run through the statistics on the growth of newcomers in Portugal as far back as 1980 to see the dynamics. Unfortunately, the SEF does not spoil us with velocities – on their website, there are reports on this only up to and including 2021. To this data, we must add a good hundred thousand residences issued in the last year, as well as the unknown number of people who live illegally or are in a status of waiting documents. Thus, you can roughly imagine the accurate picture.

Factor #3 – Lack of government regulation. Some experts believe that immigrants may have been the catalyst for the explosion of the real estate market, but the situation evolved as it did because government policy allowed it to do so. The real estate market in Portugal is extremely poorly regulated, and there is virtually no oversight. Market participants are extremely dissatisfied with the slow and ineffective measures taken by the government to stabilize prices. Below we focus on some measures to regulate and support the sector.

In 2022, there was only talk about the upcoming budget amendments for 2023, expecting the Portuguese government to decide to increase the property tax (IMI) by 100% for properties for rent, as entire areas of significant cities in the country were unavailable for sale or rent to local citizens due to tourist pressure. The decision to raise the tax by 50% for properties owned by foundations and companies and by 25% for vacant housing was discussed. And now let's take a brief look at what we have in fact at the beginning of 2023, both in the capital and in the country:

- Investment in urban regeneration in Portugal under the IFRRU 2020 investment program reached €1.4 billion in October, announced by the Ministry of Infrastructure and Housing, with 203 of the 430 contracts signed under the program will have a residential purpose.

- On January 20, 2023, the National Housing Program until 2026 (Programa de Habitação até 2026) was approved. 22 measures of the program aimed at addressing shortcomings in the housing sector, with €2,377 million allocated to strengthen the public housing stock, €183 million to stimulate the private and social supply of affordable housing, and €167 million to respond to emergencies. The project is financed from the state budget using national and European funds. To summarize the achievements of this program, they are as follows: the creation of public housing stock; a national exchange for term and temporary housing; promotion of private rental offers at affordable prices, development of the Porta 65 youth housing program; support for the housing stock rehabilitation program for rentals; promotion of long-term rental contracts, tenant rights protection, rent oversight; continuation of the already mentioned IFRRU, only now 2030. There's another very interesting point – the promotion of new cooperative and shared housing models under the goal "Innovation and Sustainability," implementing a pilot project on public housing.

- The Affordable Housing Rental Program is still open throughout Portugal. All residents in the country with proof of income but without owned property in the Lisbon region can apply. You can find all information about the program and apply to participate here. The program is called Reabilitar para Arrendar - Habitação Acessível.

- The rent increase is limited to a 2% increase in 2023 if you have a lease agreement before January 1, 2022. At the last Council of Ministers meeting, the Portuguese government announced a plan to combat inflation and decided that landlords can increase rents in 2023 by a maximum of 2% (instead of the original 5.43%). In practice, the increase cannot exceed two euros for every €100 of rent. Thus, the Portuguese government follows the example of Spain and France, which have limited rent increases to 2% and 3.5%, respectively. And to ensure that landlords who rent out their properties (again, we are talking about contracts they signed until the end of 2021) are not affected by this situation, the government has adopted special tax incentives. The anti-inflation package allows landlords to receive tax credits ranging from 9% to 30% under the IRS and 13% under the IRC.

And are there any support measures for those who bought a house and took out a mortgage? Decreto-Lei n.º 80-A/2022, passed on November 25, 2022, and in effect until December 31, 2023, establishes measures to mitigate the impact of rising interest rates on loan contracts for the purchase or construction of home ownership. The provisions of the law apply to loan contracts with an outstanding amount of €300,000 or less. I mentioned above the so-called effort ratio, i.e., the percentage of the amount of the loan obligations concerning the payer's income. The new law takes effect when the effort ratio reaches 36%. The borrower is offered numerous measures to restructure the loan – from the possibility of partial or complete loan repayment from savings without charging fees to increasing the loan term and reducing monthly payments, respectively. The bank can apply to the borrower himself with an application to review his loan agreement, having on hand sufficient documents to confirm the deterioration of his welfare, and the bank itself is periodically entitled to request the necessary information.

It is also possible to take advantage of other measures unrelated to the real estate sector, which will indirectly help replenish the family budget (reduced VAT on electricity bills and reduced fuel prices for families with a gross income of up to €2,700). The Portuguese government has so far not ruled out additional measures to mitigate the effects of inflation and help families with mortgages cope with rising interest rates.

After all, what about prices?

Buying. House sale prices in Portugal (mainland) are up 18.7% in 2022, the highest annual increase in 30 years, according to the Confidencial Imobiliário residential real estate price index (their website, by the way, has many more entertaining factual estate-related findings in an accessible infographic). Similar growth was only in 1991 – 18.8%. The year 2022 confirmed the strong price growth seen since 2014.

Interestingly, the same Confidencial Imobiliário reports that the number of houses for sale in Portugal has fallen to a 15-year low. Thus, in the 4th quarter of 2022, there were about 47,300 homes for sale in mainland Portugal, of which 17,600 were new homes (37%), and 29,600 were from the secondary market (63%).

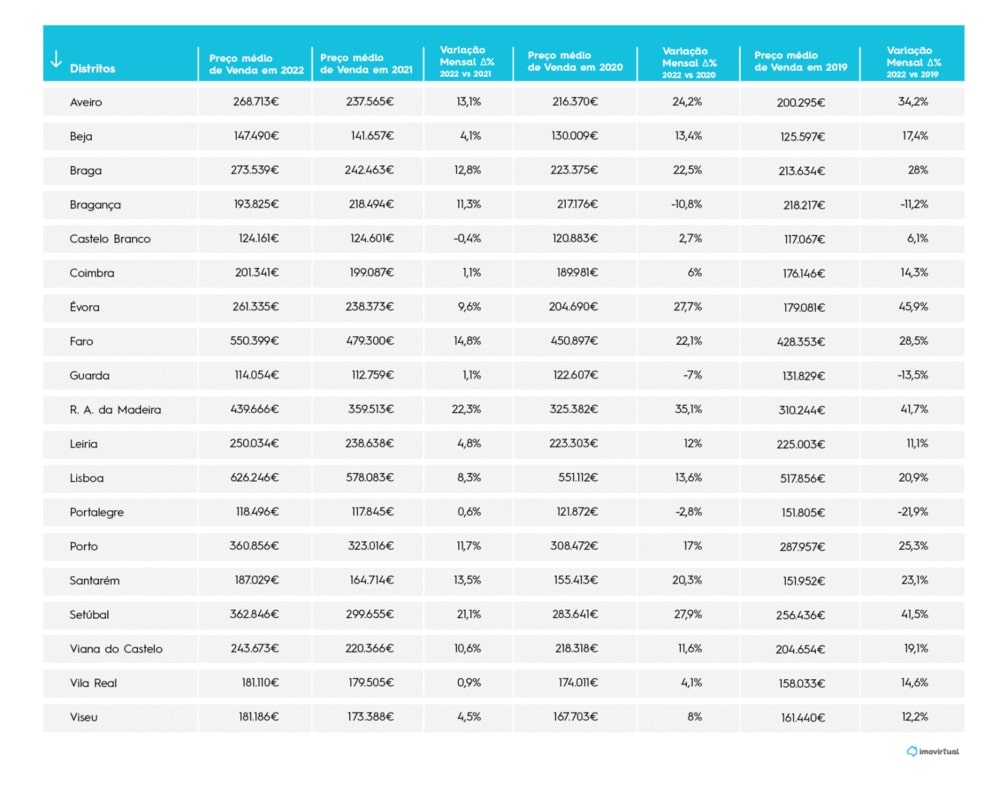

The record holder in the dynamics for 2022 was Funchal, the capital of Madeira has the highest value in the ranking of price increases – +22.3% (and with 2020 all 35.1%), followed by Setúbal (+21.1%). The only price decline compared to 2021 was Bragança (-11.3%).

The average price of real estate for sale in Portugal on the popular portal Imovirtual during the year 2022 was 395,458 euros. Compared to 2021, the price has increased by 9%, but compared to 2020 and 2019, the increase is more significant - 14.5% and 21.8%, respectively. Lisbon (€626,246), Faro (€550,399), and Madeira (€439,666) will remain the most expensive regions in 2022. In contrast, Guarda (€114,054) and Portalegre (€118,496) are the cheapest places to buy a home.

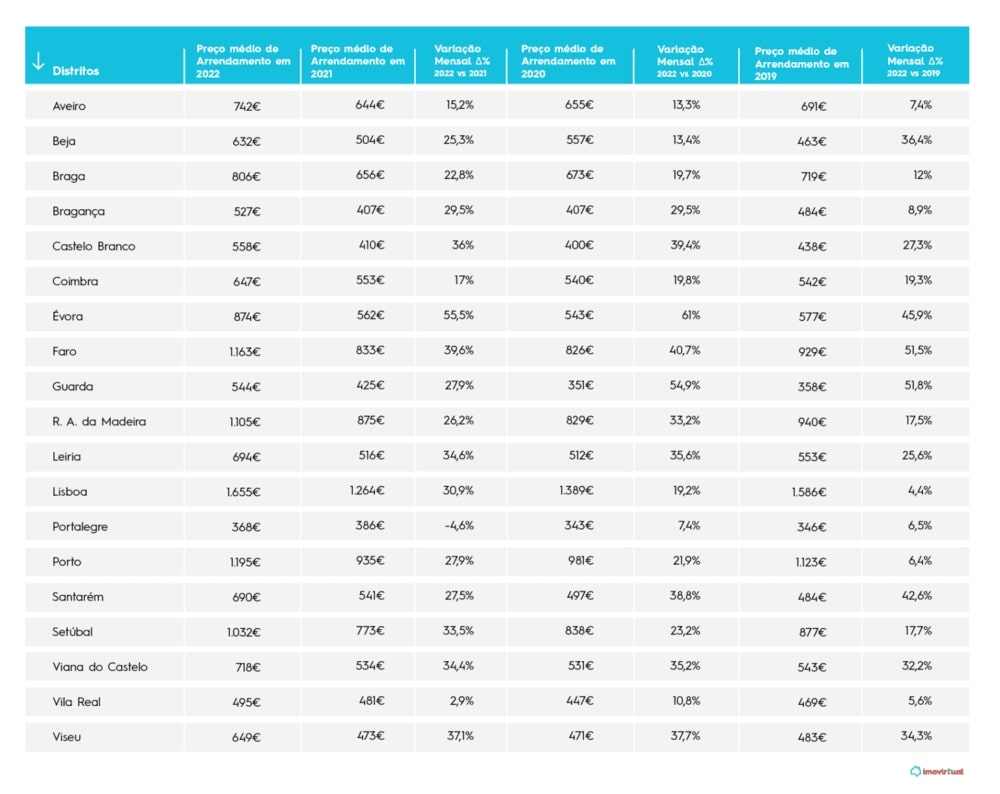

Rentals. Analyzing the last four years, we can see that in 2022 the value of the average rent (€1,269) is again close to that of 2019 (€1,242), an increase of only +2.2%. However, due to the decrease in rents in previous years, there was a +17.5% increase in 2022 compared to 2020 and a +24.8% increase compared to 2021.

In 2022, the most expensive areas with rents above €1,000 were Lisbon (€1,655), Porto (€1,195), Faro (€1,163), Funchal (€1,105), and Setubal (€1,032). As in the case of buying and selling, the rental market is unchanged – the cheapest was Portalegre (€368) and Bragança (€527) but the city of Vila Real (€495) was added to them.

The most deplorable situation today is probably in Lisbon - the Lisbon Tenants Association (AIL) reports on the difficulty of finding accommodation, citing the limited supply. Buying property in Lisbon is becoming increasingly complex, and these same difficulties are beginning to affect those trying to rent. Prices are skyrocketing, and the vast demand from foreigners is worsening the situation. Of course, rents in Lisbon have never been the most affordable, but lately, the price rises have increased, and rents are becoming unaffordable for low-income families. It is because the supply is increasingly inadequate, as part was redirected to tourism and another to foreign investors (including candidates for so-called "golden visas") with greater purchasing power than the Portuguese.

Is the housing market crash coming? Market forecasts for 2023

Home prices continue to rise in some European countries, while growth in others is slowing. The European Central Bank (ECB) estimates that home prices in the Eurozone will fall 9% over the next two years. Against this background, Avalon Investment Research has prepared an analysis of the global real estate sector with projections until 2023. Unlike the stock market, the real estate sector needs time for the falling market to lead to a decrease in home prices. When consumer demand falls, real estate prices do not fall immediately, the market dries up, and the number of transactions decreases. After a few months, sellers begin to lower costs. When homes fail to sell, many sellers consider removing them altogether. It leads to less supply and fewer transactions. Eventually, however, home prices fall anyway, as landlords become forced sellers for various economic reasons.

Analysts' opinions on the prospects of the real estate market differ: some fear a crisis similar to that of 2008, while others believe that the world will experience a recession in real estate. In general, no one has canceled the law of supply and demand: with increased supply, the price decreases, and with decreased supply, the price increases. In the last decade, there has been a supply shortage in Portugal due to increased demand. And if in the housing market, this situation is fair, the lack of an active rental market complicates the housing problem of middle-class families.

Today, renting a home instead of buying your own is becoming an increasingly attractive option for many Portuguese residents at a time when inflation is squeezing household budgets and rising mortgage costs. So, too, for those coming from abroad. It is because the rental market is more flexible and less bureaucratic than the buying and selling market and requires fewer savings and costs. But even here, there is not enough housing for a such great demand. Statistics indicate that the supply of homes for rent in Portugal fell 40% in the fourth quarter of 2022 compared to the volume available in the same period in 2021, according to a study by Idealista, Portugal's leading real estate marketplace.

There will likely be resale cases, due to the inability to pay a loan, for example, but it's unlikely to be enough to crash the market. The buying market is experiencing a downward trend as many buyers who wanted to take out a loan leave and investors feel less confident about taking out loans. In addition, the economy is still suffering from the effects of COVID-19.

To summarize a little. Looking at the peak prices, constantly flashing news that the Portuguese government will cancel the program of "golden visas," etc., we can assume that at the time of this writing, the real estate purchase in Portugal is still worth postponing until better times. If you are a player in the rental market, then prepare for the additional costs and complexities in an attempt to find a cozy little nest, possibly reoriented by the location or the requirements for housing in general. We will have to live through this difficult period, assessing the prognosis soberly – expect the sector to stabilize in the next couple of years. But, be that as it may, Portugal has been, remains, and, it seems, will be one of the attractive countries for investment, even in the worst of forecasts.

The author wishes good luck and patience to those in the process of buying or renting; everything will surely work out. Our website has an article about the nuances of long-term rentals and the difficulties when buying. To search for real estate for rent and purchase, use the popular aggregators Idealista and Imovirtual, or you can try the Facebook marketplace.

If you need advice or support for a real estate transaction, our website has certified real estate agents; a cryptocurrency exchange, or a personal assistant.

Welcome to Portugal!