Do you have a regular source of passive income and dream of living in a country with a warm climate on the ocean? This is quite possible in a European country like Portugal. At the same time, it does not matter what the source of your passive income is - it can be either a pension or income from renting out your property. A rentier visa or a visa for pensioners, most often this is the type of resident visa D7 in Portugal, and today we will talk in detail about this kind of visa and the corresponding method of immigration to Portugal

New introductory for the issuance of D7 visas

In October 2021, for the first time, the Portuguese consulates in some countries began to receive official and documented information that D7 visas began to be issued not only to pensioners, landlords, clergy, and people with passive income but also to the so-called "digital nomads", in other words, digital nomads - people working in the field of IT (and not only) remotely. Previously, this trend has already been observed, but only since October 2021, this information has been officially published on the websites of consulates.

As a result, the line about the presence of "permanent passive income" disappeared from the list of documents, and now the requirement for D7 is formulated as follows:

"Documentary proof, with a certified translation into Portuguese, of the existence of a permanent financial income for a certain long period. At the same time, a long term means that in the past, you had a regular and legal income for at least twelve calendar months, you continue receiving it at this point, and after entering the territory of Portugal, you will also continue to have this income. For example, the minimum monthly income in 2022 is 705 euros per person. A prerequisite for submitting a set of documents is the presence of a bank account in Portugal with an opening balance of at least 8,460 euros (for 1 adult). A bank statement may be submitted in English if presented on an official banking form.

That is exactly what the official wording of the new requirements for obtaining a D7 visa in one of the Portuguese consulates looks like. That is, note that now the main requirement is not to have a "constant passive income", as it was before, but "to have a constant financial income over a long period", that is, such a description may also fit the salary of a remote employee and even income from the private entrepreneurial activity of the same programmer or other specialist working for himself.

In addition, please note that to obtain a D7 visa, consulates already some time ago began to require documents confirming the presence of a place of residence on a long-term basis for at least 365 days. If you already have your property in Portugal, then it will not be difficult for you to provide supporting documents, and if not, you will not be able to do it without help. Many are confused about how it is generally possible to conclude a contract for 1 year, even without being in the country. This can be done, for example, by contacting real estate agents in Portugal or an immigration consultant in Portugal, which can also help with solving this issue remotely.

If you consider yourself a "digital nomad", then congratulations! It looks like your time has finally come, and Portuguese immigration law has begun to formalize the path for your immigration to Portugal. We hope you found this update helpful, and we will continue to follow the news in the field of immigration law for freelancers who consider themselves to be "digital nomads".

Who is the D7 visa for in Portugal?

Earlier, in one of our articles, we already wrote about the D7 residence visa for pensioners or renters, so if you are a pensioner and your relatives already live in Portugal, we advise that you familiarize yourself first with the materials in this article.

To summarize, the D7 visa in Portugal is planned for the following groups of citizens:

- For pensioners who receive a pension of at least 705 euros per person (the minimum salary in Portugal for 2022);

- For people who can prove they have passive income, for example, funds from renting out real estate in their country or stable passive income from other sources (for example, income from financial investments, royalties, etc.);

- For representatives of the clergy and ministers of the church, sent by the church to Portugal. This is a relatively rare case for immigration, but nevertheless, it also applies to this type of visa.

Logically, the first and second points can be combined, and your passive income may consist of a pension plus income from other sources, but it is crucial to emphasize the passivity of these incomes. This means that it cannot include salary, savings, deposits, or income from your business activities.

As we noted above, recently, D7 visas in many countries have been issued to freelancers and "digital nomads", in which case this income is just active, so we recommend that you check this moment with the Portuguese consulate in your country of residence. However, starting from 2021, D7 visas in many countries began to be issued not only to people with passive income - this is already an actual fact.

What should be the amount of passive income?

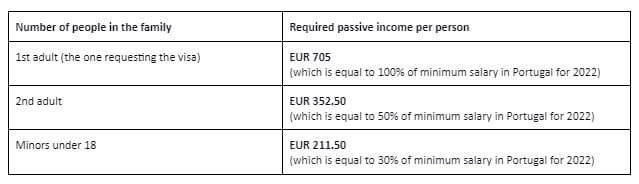

As you can already understand, the essential condition for obtaining a D7 visa in Portugal is that the person who will apply for a visa has passive income. What should be the size of this income, mainly if the family consists of more than one person?

Schematically, we can represent the required amount of cash as follows:

In practice, this means the following. For example, if you are two pensioners (husband and wife), you will need to provide evidence of passive income in the amount of 1,057.50 euros per family. If you have a minor child in addition, then the minimum income for a family of three will be 1,269 euros.

At the same time, these amounts will be adjusted every year following the size of the minimum salary in Portugal in a particular year. Therefore, the current values of the minimum necessary means of subsistence can always be checked on the SEF portal.

D7 visa obtaining process and the list of required documents

The process of obtaining a D7 visa is quite simple and can be represented schematically.

- Step 1. Collecting all necessary documents for a D7 residence visa

- Step 2. Personal submission of these documents at the consulate of your country

- Step 3. The term of consideration of your documents usually takes up to 60 days, after which, in case of a positive decision, you become the owner of the cherished D7 visa

- Step 4. Then, upon arrival in Portugal with a D7 visa, you will be able to obtain a residence permit on this basis at the SEF office, and after 5 years, you can apply for citizenship

It is always better to check the documents required for obtaining a D7 visa directly at the consulate of the country of your residence, in addition, a general list can always be found on this official portal or at Eportugal website.

Most often, the consulate of your country will ask you to provide the following documents:

- Visa Application

- 2 color photographs 3x4

- Passport and its photocopy

- Evidence that you have the minimum necessary financial means to live in Portugal (for example, bank statements, etc.)

- Proof of your residence in Portugal (this could be a house you own, a rental contract, etc.)

- Certificate of non-conviction with an apostille

- Permission to check your criminal status (convictions) in Portugal

- Medical insurance

If you are a pensioner, you will additionally need to provide:

- A photocopy of the pension certificate, which indicates the amount of the pension, as well as other documents, and certificates confirming the amount of the pension

If you have another source of passive income:

- Proof of passive, permanent, and declared income in the required amount (this can be a rental agreement, contracts for royalties, etc.)

Important: All documents, certificates, or certificates must usually be provided with a notarized translation into Portuguese and only through personal presence. And once again, we remind you that you can combine passive income sources (for example, pension + rental income). Before collecting the necessary package of documents, we recommend that you consult with the consulate in your country.

D7 visa in Portugal - the easiest immigration option for people with passive income and a new immigration option for freelancers and "digital nomads"

And this is true because by creating this type of resident visa, Portugal pursued only one goal - to attract people with a stable income to strengthen the country's economy. That is why obtaining a D7 visa can seem so simple and transparent because there is no reason for the government to complicate immigration for solvent people who have a constant source of passive income.

Recently, there has been a trend that Portuguese consulates in many countries have begun to issue visas to people with an active income, for example, freelancers and "digital nomads", which cannot but rejoice.

If you are such a person, then immigration to Portugal will be a perfect choice. Warm climate, high level of safety, low cost of living, and high quality of life. Isn't this a dream come true for any retiree, rentier, or freelancer working remotely?

Frequently asked Questions (FAQ)

Yes, this type of residence visa and the residence permit obtained will allow you to work in Portugal subsequently.

Sure. As the holder of any other type D resident visa in Portugal, you will be able to exercise the right to reunite with your family. This means that your closest members of the family, such as a spouse, minor children, etc. will also be able to immigrate to Portugal and live, study and work on its territory.

Even with a small pension, this can be done, for example, if there is income from the rental of movable or immovable property, which most often pensioners have. In addition, if you read the article materials above, you will see that if you have two pensioners (for example, a spouse and a spouse), then the amount of required income will already be less than 705 euros per person.