Today, banks are important institutions for supporting any commercial activity because, in addition to offering financial services, they facilitate payment transactions and provide personal loans, helping develop national and international trade. Moreover, having a bank account for many years in a particular bank makes it easier to get a mortgage for a future home, car, or consumer loan. In this article, we will tell you how and in which bank to open your personal account in Portugal.

In every country, there are many banks in which it is possible to open an account, and Portugal is no exception. It is not surprising that the very process of creating your personal account is not complicated, but you need to understand in which bank you should do this. Portugal is a country open to investment both nationally and internationally, so it is not surprising that many international banks are present here.

According to Bancos de Portugal's website, 45 national and international banking institutions exist and fulfill their functions throughout the country. Choosing the right bank to open an account can be a daunting task with so many of them. To help you with this task, we have created a ranking of Portugal's best and worst banks according to criteria such as opening and maintaining bank accounts, deposits, and obtaining mortgages and personal and car loans.

The Portuguese banking system is considered one of the best in Europe and throughout the world. This is because Portugal has shown progress in the economic sphere even today. According to international forecasts and estimates, it has become an excellent option for investors and entrepreneurs. Despite this, Portugal is considered one of the poorest countries in the European Union (EU). Opening your personal account in any of the banks in Portugal is not difficult. However, not all banking institutions are trusted and have a good reputation among their customers. In recent times, traditional banking in Portugal has been getting a low rating from consumers more and more often. Often, dissatisfaction and complaints from customers arise due to high commissions, including bank commissions, and difficulties in communicating with employees of institutions.

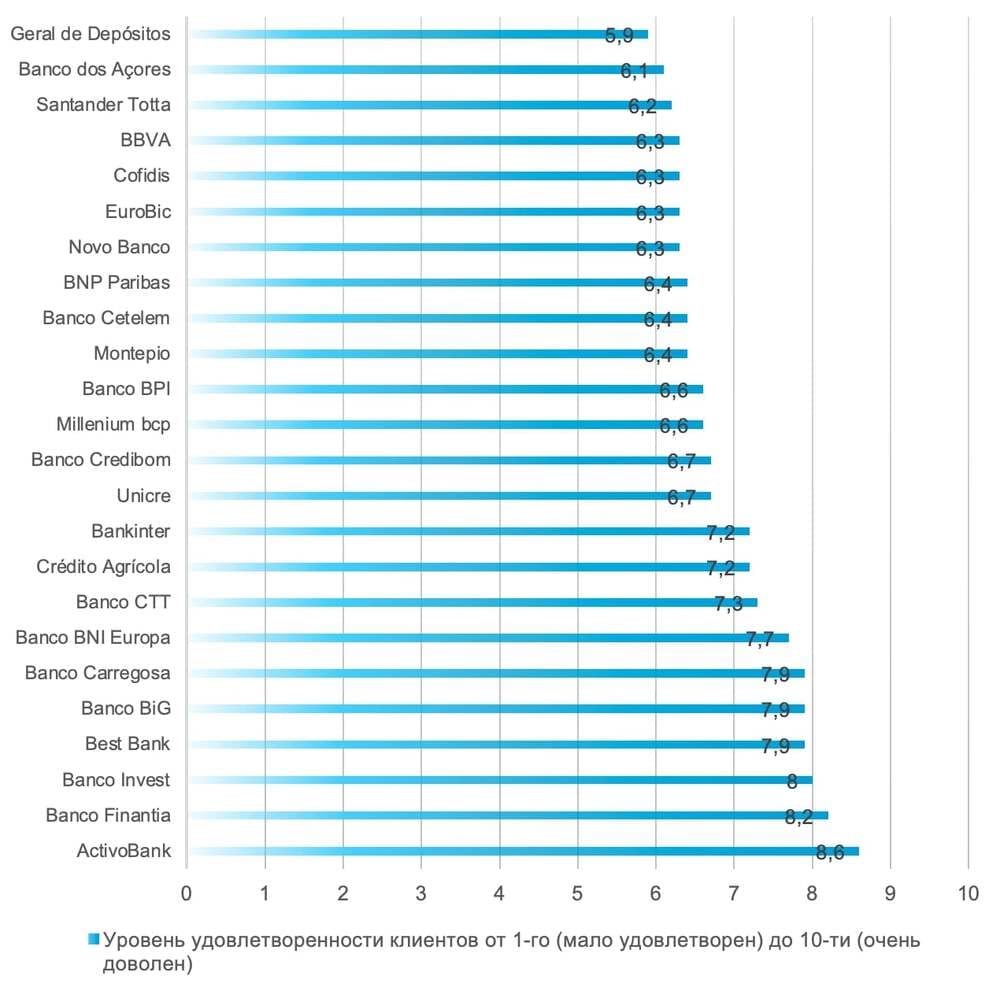

According to data obtained from the official consumer protection website in Portugal, Deco Protest, as shown in Bar Chart 1, the following ranking of the best and worst banks in Portugal is created. Thus, the top 5 best banks in Portugal include ActivoBank, Banco Finantia, Banco Invest, Best Bank, and Banco BiG. While the top 5 worst banking institutions in Portugal include banks such as Cofidis, BBVA, Santander Totta, Banco dos Açores and Geral de Depósitos.

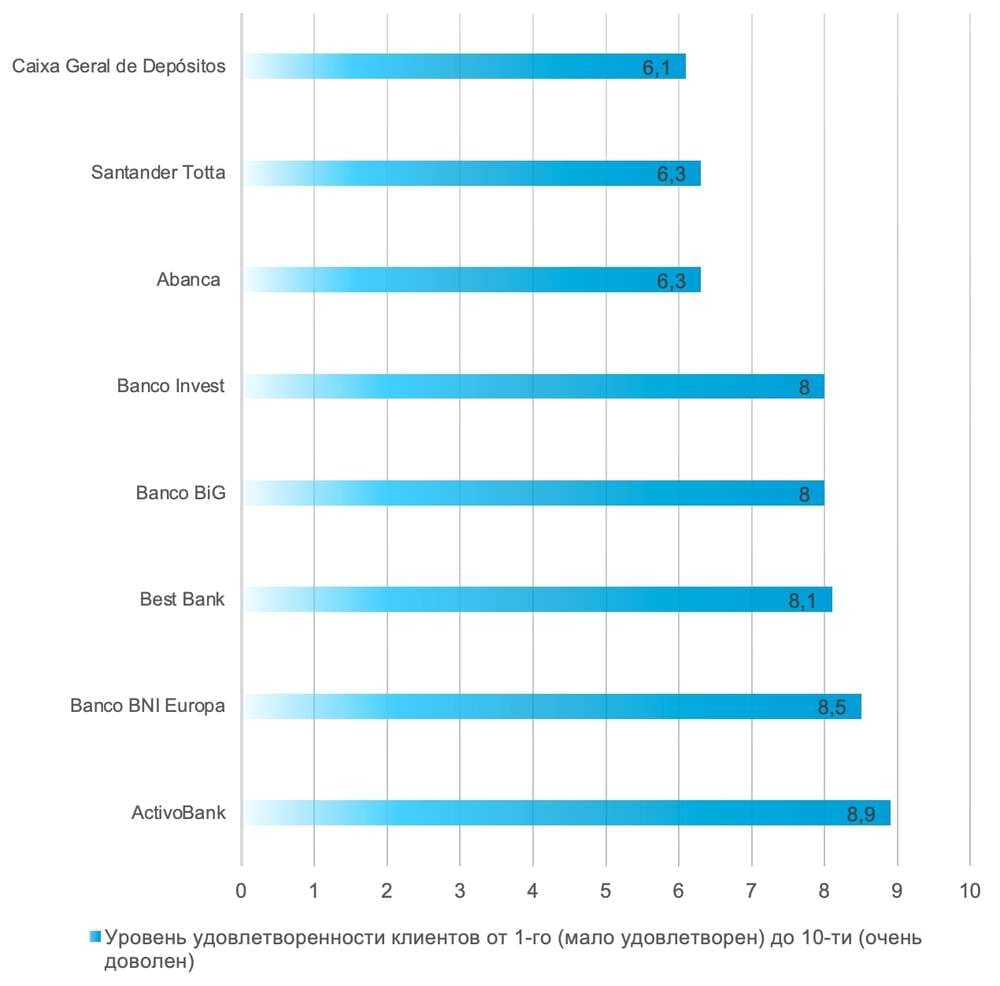

However, the rating of banking institutions in Portugal does not end there. The following main criteria for customer satisfaction of various banking institutions are the conditions for a banking product, specifically the opening and maintenance of personal accounts, deposits, mortgages, and car and consumer loans. Let's analyze everything step-by-step. As for opening and maintaining personal bank accounts in Portugal, as shown in Bar Chart 2, consumers prefer to cooperate with ActivoBank because of the low cost of maintenance and ease of managing their personal accounts.

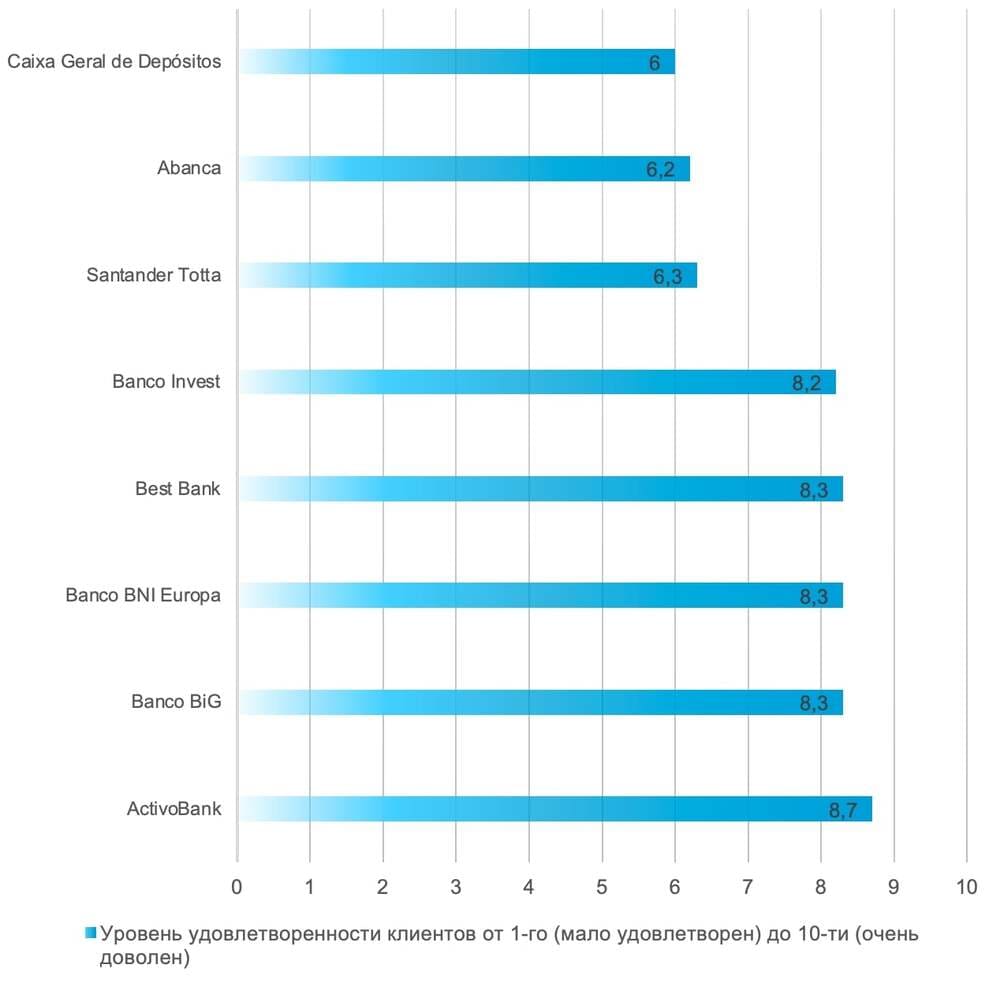

Today, many people increasingly make bank deposits, transferring certain amounts of money to banking institutions to receive income in interest generated during financial transactions with the deposit. Before making such an important decision, it is necessary to clearly understand which banks enjoy the trust of their customers in the field of bank deposits and conscientiously perform their duties. According to a survey of users of banking institutions in Portugal conducted by a consumer protection organization, in recent times, almost 20% of respondents believe that the profit received from deposits is lower than expected. ActivoBank is considered the leading bank, while Caixa Geral de Depósitos takes the last place in this category again.

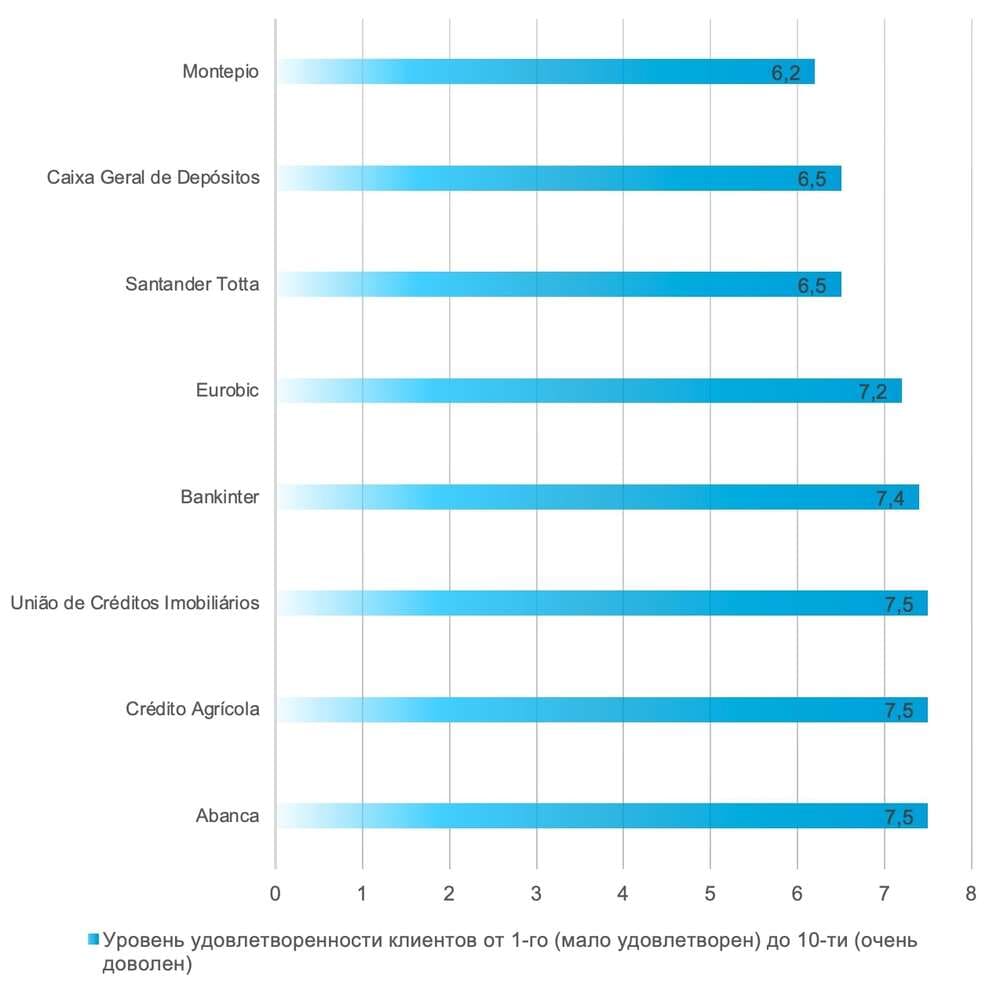

The following important criterion for evaluating banking institutions in Portugal is a home loan. In Portugal, real estate is considered quite expensive, so not everyone has the opportunity to purchase real estate for the full price and immediately. That is why the practice of taking mortgages is quite widespread in Portugal. In this category, the leadership is shared by three banks: Abanca, Crédito Agrícola, and União de Créditos Imobiliários, where the first two banks are considered the best in terms of lending conditions and the process of obtaining a loan.

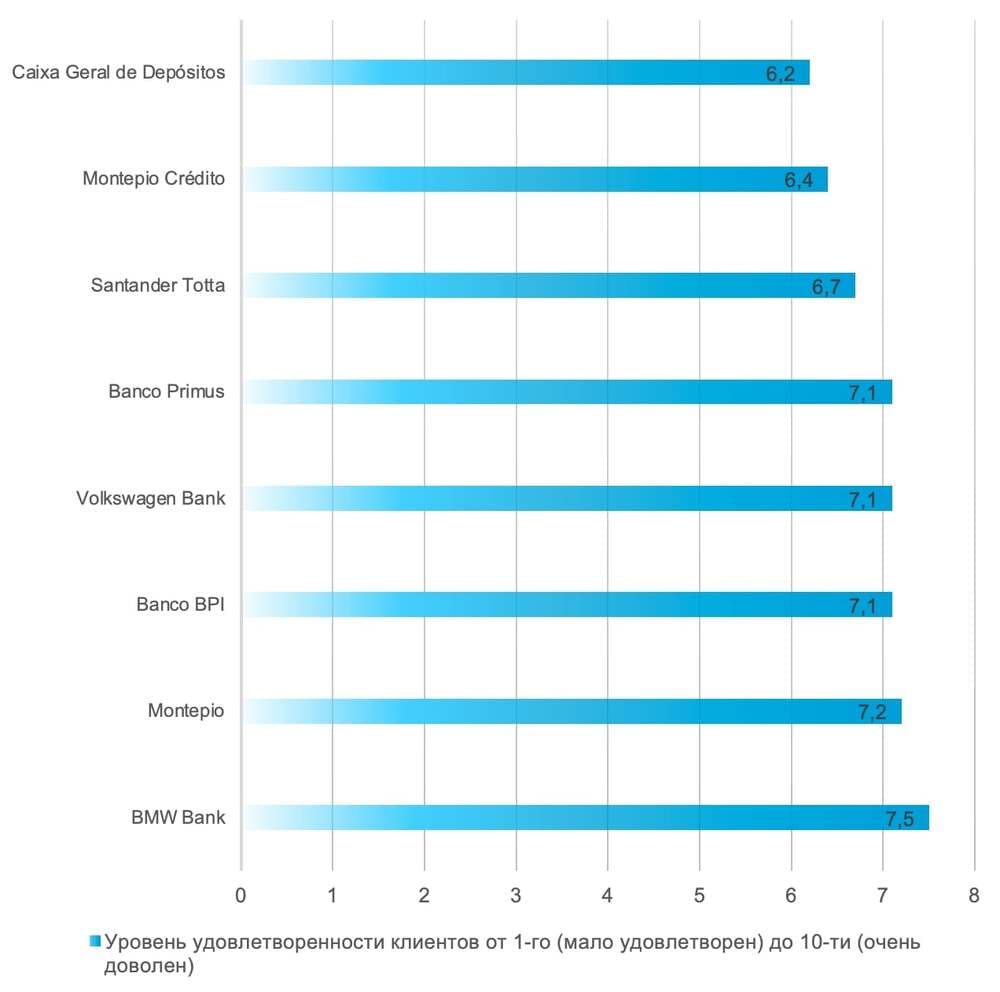

Another important criterion is a loan for movable property, specifically a car. In Portugal, a car loan is the easiest to obtain and maintain. However, consumers remain dissatisfied due to certain additional costs for this type of loan. BMW Bank ranks first in this category, offering favorable terms, while Caixa Geral de Depósitos is last.

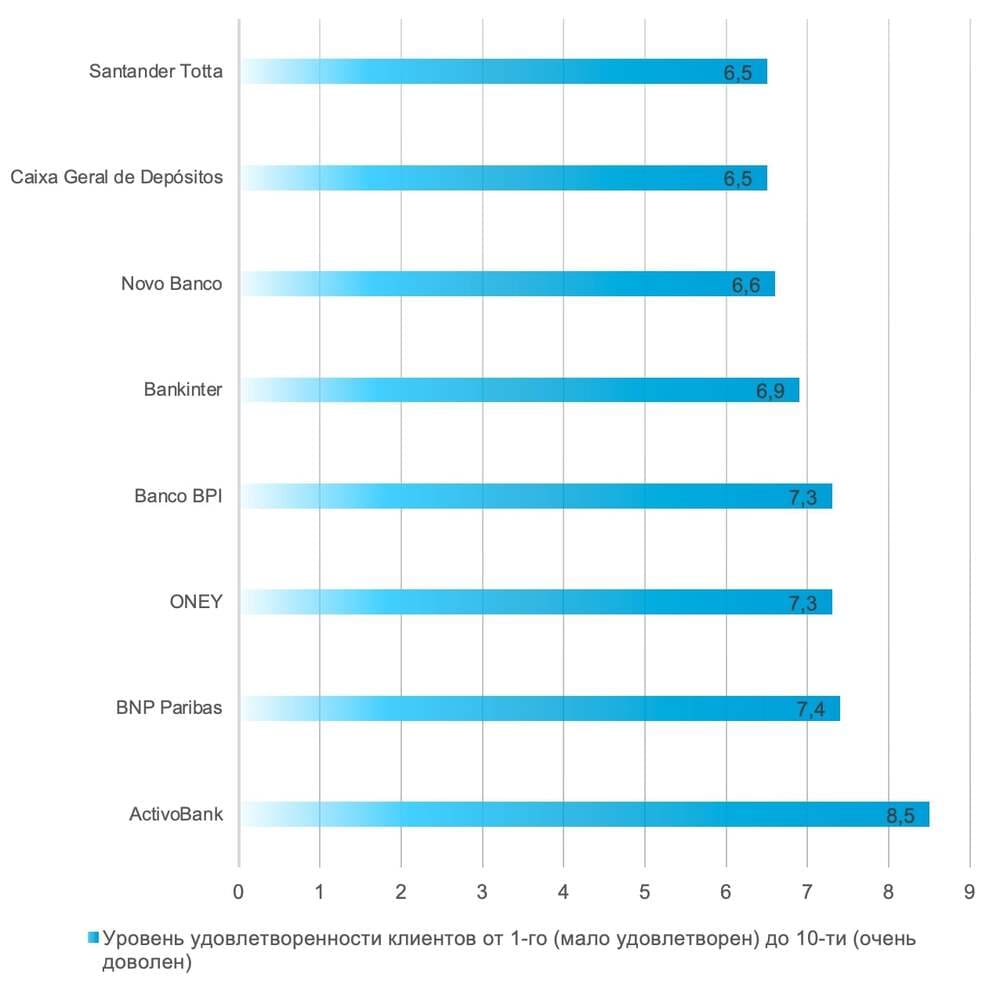

The last item in assessing banking institutions in Portugal is consumer credit. Unfortunately, consumer loans are not profitable loans for both the bank itself and the borrower due to the high interest that he and/or she has to repay. Thus, ActivoBank is considered the best bank in this category, and Santander Totta is considered the worst.

Understanding which banks are the best and worst in each category makes it possible to discuss opening and maintaining personal accounts with Portugal's most popular banking institutions. According to a survey conducted by Bancos de Portugal, the most popular banking institutions in Portugal are ActivoBank, Banco CTT, Caixa Geral de Depósitos, Banco Millenium BCP, BPI, Montepio, Novo Banco, and Santander Totta.

However, remember that when opening a personal account or obtaining any loan, you should carefully study the terms of the transaction between the banking institution and you to avoid subsequent problems and troubles.

ActivoBank

ActivoBank is one of the first digital banks in Portugal, established in 1994 and owned by the Millennium BCP Group, the largest private bank in the country. Many residents of Portugal, including young people, choose this particular banking institution because of its easy terms of cooperation, and more specifically, because of the simplified language of communication with customers, ease of opening a bank account, ease of maintenance, reasonable service fees, and maintenance of personal accounts. Among the main concepts of ActivoBank are the following:

- no annual fees for cards and account maintenance;

- the bank is always at the fingertips of its customers thanks to two completely innovative mobile applications;

- fast account opening with immediate access to cards;

- schedule of 15 bank branches in cities such as Aveiro, Braga, Cascais, Coimbra, Leiria, Lisboa, Matosinhos, Porto, and Vila Nova de Gaia (Vila Nova de Gaia) is from Monday to Saturday from 10:00 to 20:00, which is unusual for banks in Portugal, because their regular opening hours are from 8:00 to 15:00. The exact address of each of the branches and their working hours can be found on the official website ActivoBank;

- advising and assisting its users not only in their physical offices, but also by phone, Skype and/or e-mail;

- as customers use their personal account (for example, payroll, consumer, auto, and/or mortgage loans), they can also earn points through the program Active+ and redeem vouchers received through this application for services and products at supermarkets, gas stations, and other commercial stores such as FNAC and Decathlon.

Thanks to these rules, the bank has been the first among other banking institutions over the past five years, confidently leading in such nominations as the best digital bank and the best bank in Portugal, according to consumers.

As mentioned earlier, ActivoBank differs from most traditional banks in Portugal with its ease of opening a personal account. To do this, the client should contact the nearest physical branch of this banking institution, or you can carry out this process online, without leaving your home, through the official website of ActivoBank, filling in all the requested data, attaching a copy of all necessary documents and making a video call with an ActivoBank employee to verify your identity.

So, the primary documents required to open a personal account with this bank:

- passport (passaporte), residence permit (título de residência) or citizenship card (cartão de cidadão);

- taxpayer identification number in Portugal (número de identificação fiscal, NIF);

- a document confirming your place of residence in Portugal, issued no more than 12 months ago;

- tax calculation declaration issued by the Portuguese tax authority;

- Evidence of your activities includes a document of enrollment and/or university studies for students, an employment agreement for employees or a statement of self-employment, company registration for entrepreneurs, an unemployment declaration, or a document confirming retirement.

Banco CTT

Banco CTT is a young Portuguese bank established in 2015 by the state postal organization CTT - Correios de Portugal SA. Like ActivoBank, this bank does not charge a commission for servicing its customers' accounts, which is why it is included in the list of the best banking institutions in Portugal. Moreover, more and more people in Portugal prefer to take personal car loans and mortgages in Banco CTT.

In addition, another point that attracts people to become users of this banking institution is its work schedule, which coincides with the work of the Portuguese Post, namely from Monday to Friday from 9:00 to 18:00, in addition to the services provided by telephone and e-mail. Therefore, opening a personal account in this bank is considered one of the easiest. You just need to go to Banco CTT official website and fill out the form to start the process. Once completed, you will have 30 days to go to one of the physical branches to complete the process, sign the paperwork, and receive your bank account instructions. The required documentation includes the following:

- passport (passaporte), residence permit (título de residência) or citizenship card (cartão de cidadão);

- taxpayer identification number in Portugal (número de identificação fiscal, NIF);

- a document confirming your place of residence in Portugal, issued no more than 3 months ago;

- evidence of your activities, such as a document of enrollment and/or study at a university for students, an employment agreement for employees or a statement of self-employment, company registration for entrepreneurs, an unemployment declaration, or a document confirming retirement;

- documents confirming your income in Portugal.

Caixa Geral de Depósitos

Caixa Geral de Depositos (CGD) is a Portuguese public banking corporation and the second largest bank in Portugal, established in 1876 in Lisbon. Currently, CGD Bank has branches in 23 countries on four continents. This banking institution is considered the largest Portuguese financial group with the highest domestic market share in key areas such as customer deposits, loans and advances to customers, mortgages, insurance, and property leasing (11.4%). In terms of assets, CDG ranks 109th among the largest banks in the world and 69th among other European banks. This banking institution is not as successful as ActivoBank in issuing personal, auto and/or home loans among clients. However, it is considered quite a loyal bank for investors who want to invest in the development of Portugal. Opening a personal account with CDG is not difficult. For this, you need to personally contact one of the physical branches of this bank during working hours, from 8:30 to 15:00, or do it yourself through the official website.

The package of documents for this does not differ significantly from the standard set of documents, and to open an account, you will need:

- passport (passaporte), residence permit (título de residência) or citizenship card (cartão de cidadão);

- taxpayer identification number in Portugal (número de identificação fiscal, NIF);

- a document confirming your place of residence in Portugal. The period of residence does not matter;

- evidence of your activities, such as a document of enrollment and/or study at a university for students, an employment agreement for employees or a statement of self-employment, company registration for entrepreneurs, an unemployment declaration, a document confirming retirement;

- if you are a government employee, the bank will need some documents confirming this.

Banco Millennium BCP

Banco Comercial Português was established in 1985, but after rebranding in 2004, the bank began to operate under the name Millennium BCP. This banking institution is the largest commercial private bank in the country, whose shares are included in the Euronext 100 stock index. Millennium BCP Bank is headquartered in the city of Oeiras (Oeiras), but the main work is carried out in the city of Porto (Porto). For many Europeans who have moved or are just planning to move to Portugal, the Millennium BCP bank is considered quite an interesting option, as it has branches in many EU countries, such as Poland.

As of 2021, this banking institution serves about 4.5 million people and has about 900 branches worldwide. It is possible to become a client of Millennium BCP Bank by filling out an online form on the official website or downloading the application to your smartphone or in person at one of the bank branches. You will need to provide the following documents to do this:

- passport (passaporte), residence permit (título de residência) or citizenship card (cartão de cidadão);

- taxpayer identification number in Portugal (número de identificação fiscal, NIF);

- a document confirming your place of residence in Portugal. The period of residence does not matter;

- confirmation of your activity.

BPI

Banco Portugues de Investimento (BPI) - is a large private bank in Portugal, owned by the Spanish bank CaixaBank, which conducts banking business with companies and institutional and private clients. According to the information provided on BPI official website, this bank is considered the third-largest private financial group in Portugal, with assets of 6.481 billion euros (as of 2019). The bank's headquarters is in Porto. As with many other banks, you can open an account in three ways:

- open an account online - via video call. This method of opening a personal account is quite simple. For this, you need to enter your personal data, provide the necessary evidence and make a video call with a BPI employee;

- open an account online - with a digital mobile key. Opening a BPI bank account has become much more manageable with this method. To do this, you must authenticate with a digital mobile key (chave move digital), confirm your data, check and sign documents sent by e-mail;

- open an account in person at one of the BPI bank branches, providing a standard package of documents.

Montepio

Montepio, formerly Montepio Geral, is a Portuguese mutual savings organization better known for its banking activities. Montepio Bank was founded in 1844 in Lisbon, where it is currently headquartered. Montepio Group is led by Montepio Geral (mutualist organization) including Banco Montepio (bank holding), Lusitania (insurance company), Lusitania Vida (life insurance), Fundação Montepio (social solidarity fund), Futuro (pension fund), Montepio Gestão de Activos ( investment fund management), Residências Montepio (senior residence management) and Leacock (insurance brokerage).

It is worth considering the fact that opening an account in this banking institution is not so simple. You will need the following documents*:

- passport (passaporte), residence permit (título de residência) or citizenship card (cartão de cidadão);

- if your tax and permanent address are the same, you must provide a document issued by the tax authority (tax residency declaration, IRS invoice, IMI invoice, etc.). If your tax address differs from your actual residence address, then the bank will need to get: receipts for water, electricity, gas, telephone, internet, etc.; driver's license; a document from the local council confirming your residence at the specified address; IRS estimated income tax return;

- original or certified copy of your income declaration, both in Portugal and abroad; work agreement - if available, a certificate of employment issued by the employer containing complete information about the employer and employee, position held, date of issue, validity period, and profession.

*These papers do not apply to the unemployed, self-employed, students, and/or retirees. More detailed information for these categories can be found on Montepio official website.

Novo Banco

Novo Banco - this is another Portuguese bank created on August 4, 2014, by the Bank of Portugal to rescue assets and liabilities of Banco Espirito Santo (BES). In terms of net assets, BES was Portugal's second-largest private financial institution and one of the oldest and best-known Portuguese banks, established in 1920. Novo Banco is considered a young bank rapidly gaining momentum, attracting more and more customers. The bank provides a full range of services, focusing on insurance, investments, and mortgages. To become one of Novo Banco's clients, you need to collect the following documents:

- filled-in form with your complete information;

- passport (passaporte), residence permit (título de residência) or citizenship card (cartão de cidadão);

- if your tax and permanent address are the same, you must provide a document issued by the tax authority (tax residency declaration, IRS invoice, IMI invoice, etc.). If your tax address differs from your actual residence address, then the bank will need to get: receipts for water, electricity, gas, telephone, internet, etc.; driver's license; a document from the local council confirming your residence at the specified address; IRS estimated income tax return;

- original or certified copy of your income declaration, both in Portugal and abroad; a work agreement - if available, you will also need a certificate from the place of work issued by the employer, containing complete information about the employer and employee, position held, date of issue, validity period and profession. And a document confirming your self-employment, if it was started less than 1 year ago.

Santander Totta

Santander Totta is the most prominent Spanish bank in Portugal, founded in 1988. In Portugal, Santander Totta Bank has 539 branches as of 2020, of which 280 offer access for people with disabilities. In addition, there are 2,453 Santander Totta ATMs installed in the country, which both bank customers and third parties can use.

As of 2021, the bank employs 6,781 employees and serves 4.7 million customers, of which 558,000 are digital customers. To become a client of Santander Totta Bank, you must provide the bank, either in person at one of the physical branches or online, by scanning all the necessary documentation:

- passport (passaporte), residence permit (título de residência) or citizenship card (cartão de cidadão);

- taxpayer identification number in Portugal (número de identificação fiscal, NIF);

- a document confirming your place of residence in Portugal. The period of residence does not matter;

- confirmation of your activity.

Meanwhile, human progress does not stand still. It is due to the emergence of more and more virtual banks, which are in no way inferior to traditional banking institutions, offering simple and free accounts. So, in addition to the already well-known ActivoBank, other digital banking options are actively developing their activities in Portugal, among which the following two can be distinguished:

- N26 is a German bank that started operations in 2015, carrying out all banking operations online. Moreover, this banking institution does not charge fees for servicing the personal accounts of its customers but only for certain additional services. At the moment, the bank opens accounts on a first-come, first-served basis, which immediately makes it not as attractive as the following 2 banks;

- Revolut - a British bank with an excellent mobile application and user-friendly interface, which is also gaining momentum in Portugal and, like N26, offers an account for essential services without charging any commission;

- Wise – just like Revolut, this bank is headquartered in London and is extremely popular in the country thanks to its user-friendly online application.

We wish you good luck when dealing with banks in Portugal!