If, after a thorough study of the articles on the WithPortugal website, you have decided to open your business as an independent contractor in Portugal, congratulations! Self-employment is flexible and unlimited possibilities to earn money, and in Portugal, it is especially beneficial because working for a Portuguese company as a salaried employee, you don't even have to dream about a salary increase. Indeed you have already weighed up the advantages and disadvantages and have decided to open your first individual entrepreneur in Portugal. So let's do it together, in 5 minutes online, on the portal of the Portuguese Tax Service Finanças.

Step-by-step instruction on how to open an IE in Portugal online

Well, first of all, you will need to log in to your personal account on the Finanças portal. You must already have both a Portuguese tax number and the data to access the online account on the tax office website. If you don't know what a NIF is and don't have a tax number in Portugal.

If you already have both a NIF and access to an online account on the Finanças portal, we can have you registered as an individual entrepreneur in just 5 minutes.

Step 1: Starting the process of creating an IE in Portugal

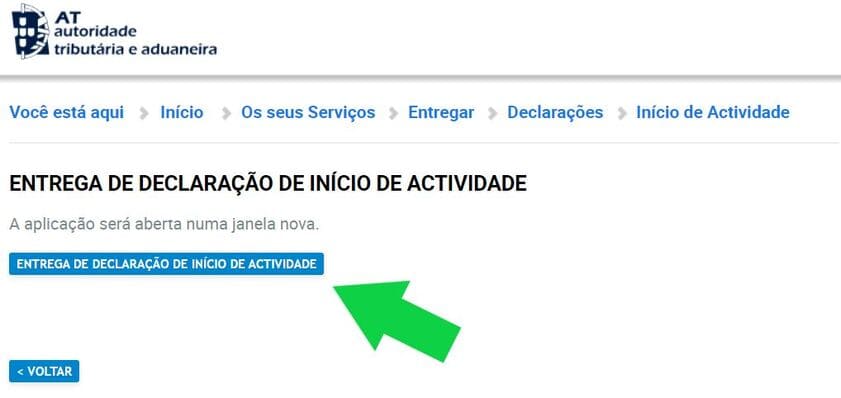

To open your business, find "Inicio de Atividade" ----" "Entregar Declaração" in the main menu of the Finanças portal. You can do this either in the search bar or by clicking on this link.

After clicking on the menu item "Entregar Declaração" you will see the following window, in which you need to click on the blue button, which you can see in the picture below.

Step 2: Fill out the declaration form

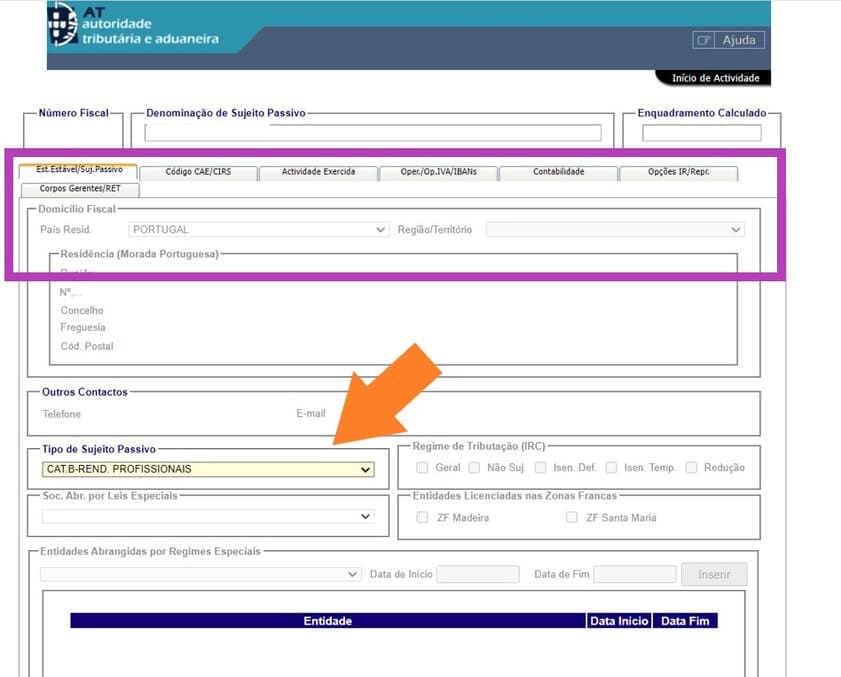

After that, you will see a form that declares you are opening your business as an individual entrepreneur in Portugal. At the top of this declaration will be your personal data (which, in the picture below, we have just deleted): your first and last name, tax number, address, phone, and email. By the way, you will not be able to change them inside this form, so we recommend that even before opening an IE in Portugal, you check that your personal information is correct and up-to-date. You can do this in your personal account on the Finanças portal or by going in person to any tax office.

Notice the top menu of the declaration, which is in the picture below, and placed in a lilac frame. In this menu, you can see different tabs, and we will need to move from one page to another, gradually filling in all the tabs.

In the first tab that opens to you, you will automatically need to select the values for the "Tipo de Sujeito Passivo" field, corresponding to the type of activity you will perform. This field has three possible values:

- Cat. B - Rendimentos Empresariais: relevant for the sale of products and for commercial deliveries;

- Cat. B - Rendimentos Empresariais e Profissionais: relevant not only for the sale of products and commercial supplies but also for services;

- Cat. B - Rendimentos Profissionais: relevant for services.

Here, the choice will depend directly on your business, but if you are not going to produce and sell products, your activity likely falls into the category "Cat. B - Rendimentos Profissionais", which could include working as a cleaner or as a financial consultant, because both are services.

The "Código CAE/CIRS" tab

Next, we need to fill in the "Código CAE/CIRS" tab, where we must mark our activity codes. Every field and activity in Portugal corresponds to a specific code, so even before opening an IE online, you can consult the CAE/CIRS codes list to choose the code or codes that are right for you.

You can find a complete list of CAE codes here and a full list of CIRS codes here. Both lists are huge but don't worry if you can't find a code that describes your activity exactly.

First, you can choose several different codes and then change them at any time in a matter of seconds in your personal account on the Finanças portal. That is, it is not something permanent, and you will always be able to change your codes/spheres of activity if you need to. Secondly, you can choose a code that is roughly similar to the activity you are doing because it is not always possible to find an exact description of your activity. For example, you can choose the CIRS code "1519 Outros prestadores de serviços", which literally means "other service providers", and in theory, it could include anything.

To understand the difference between CAE and CIRS codes, we recommend consulting an accountant in Portugal, but immigrants often choose the CIRS code "1519 Outros prestadores de serviços" and several CAE codes that correspond to their activities.

In the tab in the photo below, we have to enter at least one code in the "Atividade Principal" field, which corresponds to our main activity, and then you can start filling in codes in the "Atividades Secundárias" field, which corresponds to our secondary activities, although it is not necessary and the secondary fields can be left blank.

The "Atividade Exercida" tab

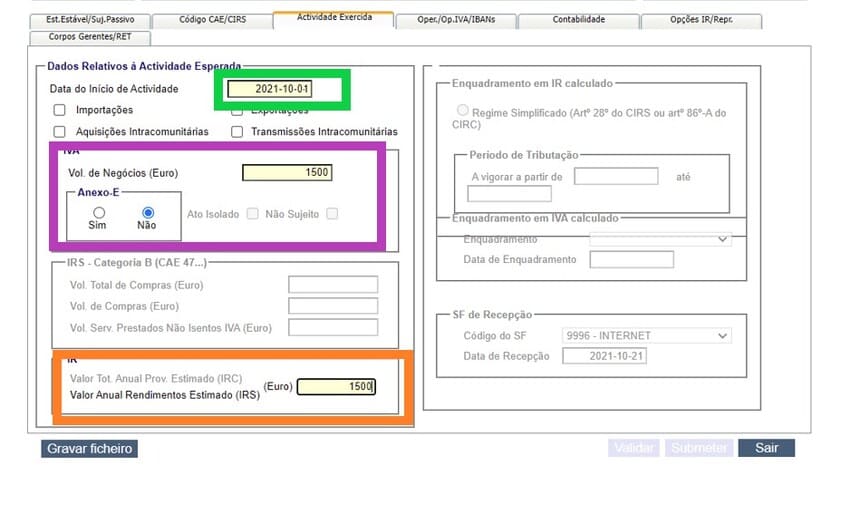

In the next tab, "Atividade Exercida" we have to choose the date of the beginning of our activity in year-month-number format (the green field in the picture below). Then, depending on whether we are going to work with the VAT regime (IVA) or not, we need to check the box "Anexo E". We don't want to work with the VAT regime in our particular case, so we choose Não (lilac box in the picture below). If you do not understand whether you need or do not need the VAT regime, read this article to the end because, in conclusion, we will explain how to choose the most appropriate option for you.

Also, in the picture below, in the lilac field IVA, we need to enter the amount of our estimated income, not for the year, but for the number of months we have left until the end of the year. Pay special attention to filling out this field because if you fill it out incorrectly, you will automatically go into VAT mode, and you may even face heavy fines if you fail to submit a VAT return out of ignorance.

Example: Pedro will start working as an individual entrepreneur in October 2021 and expects to earn 1,500 euros during the 3 months left until the end of the year. That's why in the picture below, in the lilac field Pedro enters the value of 1500.

To determine whether Pedro falls under the VAT regime or not, it is necessary to calculate how much he would have earned in a full calendar year.

That is: 1500 € / 3 months = 500 € (the amount of average earnings per month) - 500 € x 12 months = 6000 € (Pedro's estimated annual income)

Thus, since this amount is below €12,500, Pedro will be subject to the preferential treatment of Article 53 of the CIVA, i.e., he will not have to charge or pay VAT. Most immigrants in Portugal try to qualify for the reduced VAT regime (available to IEs with an income of fewer than 12,500 euros per year), so it is crucial not to make a mistake here by putting the correct amount. If anything, just put 1000 euros in the lilac field IVA and IR, it is better to put less than more, as this is just a guideline value, and if you then earn 10 times more, you will not have any problems with the tax office.

In the IR field, put the same amount (in our case, it is 1500) as in the IVA field (orange field in the picture below).

Suppose we want to avoid the VAT regime. In that case, it is imperative not to select Importações, Exportações, Aquisições e transmissões intracomunitárias, because import and export automatically qualify our activities for the VAT regime (the area above the lilac field in the picture below).

The "Oper./Op. IVA/IBANs" tab

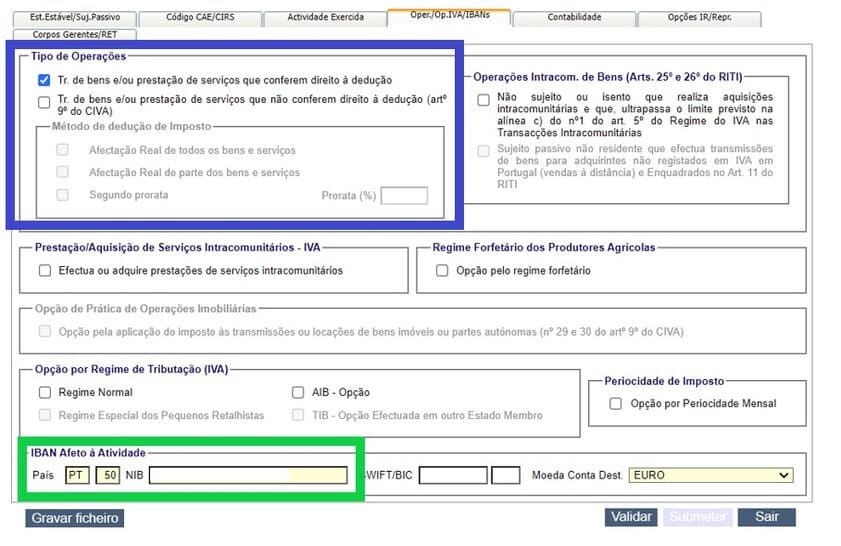

On the next tab "Oper./Op. IVA/IBANs" we will need to fill in the field "Tipo de Operações", which will relate to the nature of the activity we are performing. You will probably choose the first option "Tr. de bens e/ou prestação de serviços que conferem direito à dedução". Consult this list of Article 9 of the CIVA, and if the activity you are performing is included in this list, you will need to select the second option, namely "Tr. de bens e/ou prestação de serviços que não conferem direito à dedução (artigo 9.º do CIVA)" (blue box in the photo below).

In the IBAN field Afeto à Atividade (the green field in the picture below), you need to enter your Portuguese bank account details, which will be associated with your business activity. If you have not yet opened your bank account in Portugal, you can seek help from our partners.

If we want to avoid the VAT regime, it is essential not to select any options in the "Opção por Regime de Tributação (IVA)" field on this tab.

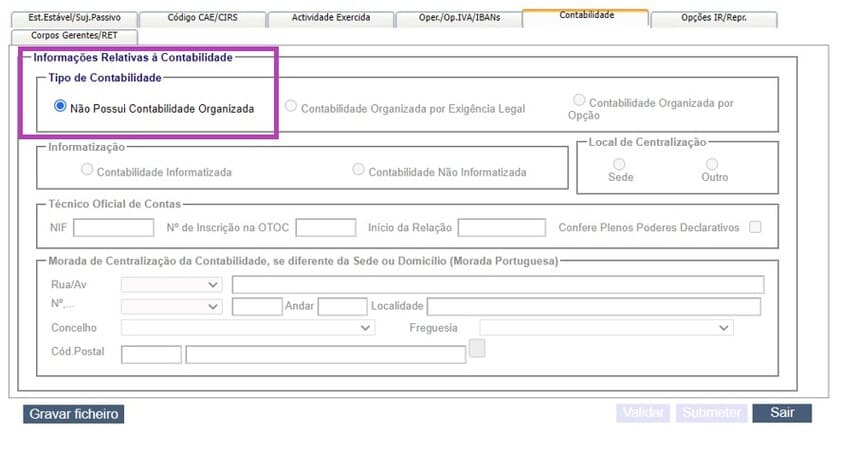

The " Contabilidade " tab

Here you do not need to fill in any fields because the field "Tipo de Contabilidade - Type of Accounting" will already be automatically filled with the option "Não Possui Contabilidade Organizada", as you can see in the picture below (purple field).

If you want to choose an organized accounting system, the declaration of the beginning of business as a sole trader must be completed by a certified accountant in Portugal, whom you will have to hire.

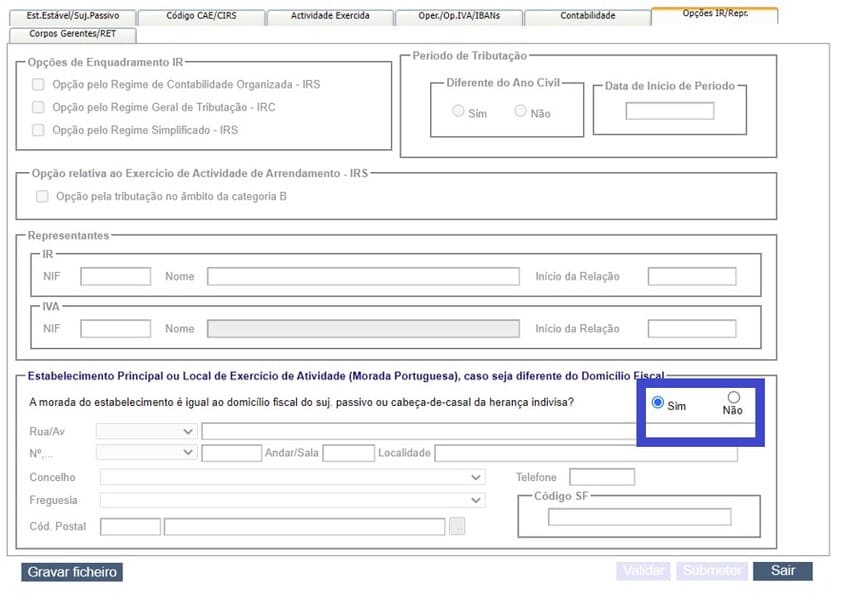

The "Opções IR/Repr" tab

In the field "Estabelecimento Principal ou Local de Exercício de Atividade (Morada Portuguesa), caso seja diferente do Domicílio Fiscal" select the option Sim if your IE address matches your home address (blue field in the picture below). If it does not, select Não and fill in your IE address.

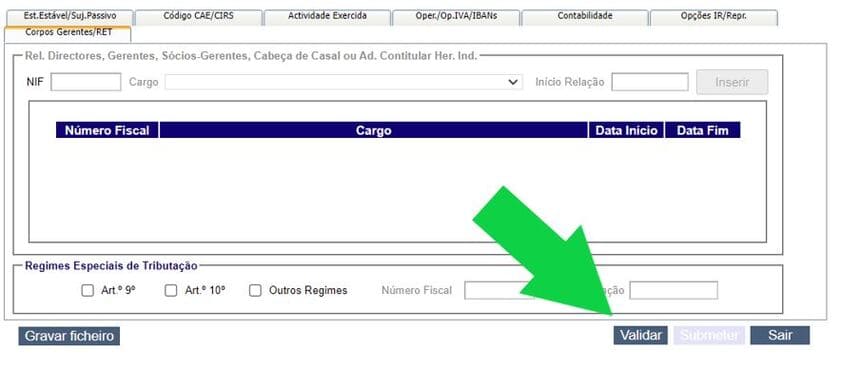

The "Corpos Gerentes/RET" tab

On this tab, there is no need to fill in any fields.

So, we've gone through all the tabs and filled out all the required fields. Once we have done this, then we have activated the "Validar" button in the bottom right corner, and after clicking on it, we will see a pop-up window, which will contain a summary of our IE, which will need to be checked for correctness of all data and if everything is correct, then we can complete the declaration by pressing the "Submeter" button. If we see any errors at this point, we can still correct the declaration before pressing the "Submeter" button.

Well, congratulations! If all goes well, once you fill out and file your return, your business will be created, and you can write your first bill for your services as an individual entrepreneur that same day. You can read how to do that in our article on how you can write a Recibo Verde online.

By the way, you can always consult and get confirmation of your registered IE, for example, by typing "Consultar Outros Dados Actividade" or "Comprovativo Início Atividade" in the search bar.

What to do in case of an error?

If suddenly you are not able to register your activity online in the Finanças portal, you can try the following:

- Start registering your IE again, but do it quickly. That is, if you fill in all the above tabs for half an hour or an hour, the site will most likely not let you finish filling out the form. So act quickly, find out, and decide in advance how and what you will fill out, and don't take too long to fill it out.

- Try a different browser or disable the adblocker. Sometimes this helps.

- Contact the Tax Information Service by phone, which you can find here, and try to figure out what the error is (but they will probably also refer to the first two items on this list).

- If the previous three options did not help solve the problem, you can go to your nearest tax office and open your business there without any issues with the help of a tax officer.

How to prepare for launching an IE in Portugal?

As you may have understood from our article, it is possible to open an individual entrepreneur activity in literally 5 minutes, online and from the comfort of your home. Nevertheless, we recommend that you think things through carefully and make the following preparations for creating an IE as early as possible:

- Consult a licensed accountant in Portugal

Paying a small fee for a consultation, you will get a very detailed explanation from an accountant about which regime is more profitable for you (with or without VAT), what activity codes are better to choose, etc.

Perhaps the specifics of your business are such that it will not only be beneficial for you to work with the VAT regime, but maybe even to open a company of another type, but not an IE. Therefore, it is essential to clearly understand what you are doing and which option will be more profitable for you, and the small amount paid for the consultation will be compensated by the absence of high fines that you may receive due to incorrectly opened individual entrepreneurship in Portugal.

- Start learning Portuguese as early as possible

Especially if you are not going to use paid consultations and the help of an accountant. You probably noticed that all of the screenshots in this article were in Portuguese. You will also have to look up your activity codes in Portuguese. So even if you work exclusively with foreign clients, you will still need knowledge of the Portuguese language to deal with the Portuguese tax authorities. The good thing is that the language can now be learned at any time of the day or night through an online Portuguese course, or you can take private lessons with a tutor.

- Stay positive and open to everything new

After all, if you want to immigrate to Portugal and decide to start a business as an individual entrepreneur in Portugal, high quality of life, flexible work schedule for yourself, sunny skies, and beautiful beaches await you. Therefore, Portugal is the perfect place to fulfill your dreams and start working for yourself!

We wish you a successful start to your independent activity as an individual entrepreneur and many new and exciting projects and clients!